Reliability Scoring for the Automotive Market

By Jeff Wilson, Mentor Graphics

Companies designing automotive electronics must understand how variability affects design quality and reliability.

The annual growth for car sales is typically in the single digits, but the electronic content inside those cars is rapidly expanding as we enter the age of the digital car. Current estimates posit up to 30% of the production cost of a new vehicle come from the electronic systems. The typical new automobile now contains over 100 microprocessors, performing various tasks from safety (braking control and sensors) to comfort (heating, cooling, seat positions) to infotainment (navigation and communication systems), as well as one of the fastest-growing uses—advanced driver assistance systems (ADAS). This explosion of automotive electronics is one of the bright spots in the current semiconductor industry, making these devices an attractive market for semiconductor companies looking to expand their markets. The challenge for any company new to the automotive market is to understand the market requirements and performance standards, especially in the area of quality and reliability. Safety, efficiency, and connectivity are the primary drivers for automotive electronic components.

Expanding Automotive Market

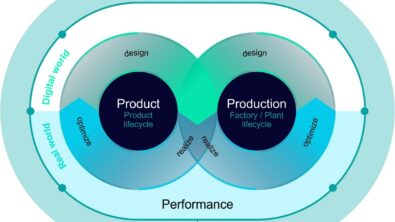

As more companies expand into this market, a key element to their success is ensuring that designs properly account for the environmental variability associated with automotive use, the stringent quality and reliability requirements with which they must comply, and consumer expectations for performance and reliability. Design teams must understand these conditions and apply the appropriate technology to solve design issues and achieve compliance.

There are a number of factors driving the need for reliability. First, there is the physical environment in which these devices must operate, which includes extreme weather conditions and broad ranges of temperatures. In addition to the climate, other environmental conditions that these devices must endure include ambient heat, vibration, and both extended and start-stop operation. Designing to meet this extended set of requirements is typically a new experience to those who have recently made the decision to produce chips for the automotive market.

Another reliability requirement that is new to most designers is the expected lifespan for their designs. While consumer products typically operate for a few years, an automotive device is expected to last at least 10-15 years. In addition, an automobile creates its own system, with a significant amount of connectivity between devices that compounds the criticality of device reliability because, in many cases, if one device fails, the entire system is compromised. This forces designers to consider previously trivial design stresses, such as time-dependent dielectric breakdown (TDDB), and learn how to analyze and account for these effects. This expected life also puts a strain on new technologies that don’t yet have a longevity track record.

In addition to environmental variability and cumulative system reliability, there is variability in the breadth of the complexity between designs. At the high end, there is the in-vehicle infotainment (IVI) market, which is simply defined as combining information and entertainment for the benefit of both the driver and the passenger. IVI brings together video display, audio, touchscreens, and connections to other devices such as smartphones and media players. The controlling systems or host processor in IVI typically utilize the latest semiconductor technology to deliver the required functionality. Memory chips, especially NAND flash, are another important semiconductor component in navigation and IVI systems.

At the low end, established technologies are known and proven for such items as safety (e.g., air bags), braking systems, power train operations, and ignition system control. The need for these chips is a major driver (along with the Internet of Things) of capacity at established nodes. This market demand puts pressure on designers to ensure they consistently maximize both yield and reliability even in these long-established designs.

Reliability Drivers

There are two major areas of reliability that must be considered during the design and verification process—electrical performance and manufacturing optimization. These two reliability-related issues have both unique requirements and overlaps. One of the biggest overlaps is the eco-system required to deliver a complete design solution, which includes the foundry, design team, and electronic design automation (EDA) solution providers. The foundry has in-depth knowledge about the manufacturing process, and can link a layout configuration to yield/reliability/robustness by putting this knowledge into a rule deck. The EDA providers supply automated functionality that allows designers to analyze their design against this rule deck to find out what and where changes can improve their design, either for electrical performance or manufacturing optimization. Now that designers have an automated solution that helps improve design reliability, they can put it to good use on their designs. In addition to improving the yield/reliability/robustness score for each design, they can use this capability to establish best practices across the company. By comparing scores from different design groups, they can determine what design techniques to use going forward. Standardizing on the best flows for their company helps improve the quality of all designs.

Designers have the responsibility of ensuring that their designs are reliable by verifying electrical performance before tapeout. The AEC electrical component qualification requirements identify wearout reliability tests, which specify the testing of several failure mechanisms:

- Electromigration

- Time-dependent dielectric breakdown (or gate oxide integrity test) — for all MOS technologies

- Hot carrier injection — for all MOS technologies below 1 micron

- Negative bias temperature instability

- Stress migration

Design verification against these failure factors ensures that the actual device electrical performance will meet reliability expectations. However, traditional IC verification flows leveraging design rule checking, layout vs. schematic, and electrical rule checking techniques may have trouble validating these requirements, because these tools each focus on one specific aspect of design verification. New EDA tools like Mentor’s Calibre® PERC™, which provides the ability to consider not only the devices in a design, but also the context in which they are used, as well as their physical implementation, can help designers understand weaknesses in their designs from a holistic approach. This “whole problem” view of a design provides visibility to interoperability issues of intellectual property (IP) used in the design.

Manufacturing reliability is driven by what is commonly referred to as design for manufacturing (DFM). DFM is about taking manufacturing data and presenting it to designers so they can improve the yield/reliability/robustness of their designs by eliminating known manufacturing issues. The most effective way to make this work is to have the same type of eco-system used to improve electrical reliability, where the participants include the foundry, designers and EDA providers. Manufacturing reliability checks are an extension of the rule deck, such as the manufacturing analysis and scoring (MAS) deck developed by Samsung and GLOBALFOUNDRIES for use with Mentor’s Calibre YieldAnalyzer™ tool. A key element in creating a functional eco-system is to provide the feedback from actual manufacturing results, so the designers understand why a particular layout structure is not suitable for complying with reliability requirements. This feedback is especially critical for those that are new to the automotive market and its additional reliability requirements. A productive solution is much more than just providing a DFM score for a layout—designers need to recognize the most important and relevant geometries, and what changes will return the greatest improvements in reliability. The ability to prioritize design work is critical to producing designs that are both cost-efficient and successful.

Summary

There is no doubt that electronics are impacting the automotive market, and this trend is expected to continue increasing. As companies move into the market to take advantage of the opportunities they see, they will need to understand how layout variabilities relate to design quality and reliability requirements. Foundries can provide the relationship between the layout and the reliability, while EDA providers supply the tools that present this data to designers in an easy-to-use automated system. As the final piece of the eco-system, designers must understand both the requirements and the solutions to ensure the design meets the stringent electronic reliability requirements while remaining profitable to manufacture.

Author

Jeff Wilson is a DFM Product Marketing Manager in the Calibre organization at Mentor Graphics in Wilsonville, OR. He has responsibility for the development of products that analyze and modify the layout to improve the robustness and quality of the design.

Liked this article? Then try this –

White Paper: Understanding Automotive Reliability and ISO 26262 for Safety-Critical Systems

White Paper: Migrating Consumer Electronics to the Automotive Market with Calibre PERC

White Paper: Enhancing Automotive Electronics Reliability Checking

This article was originally published on www.semimd.com