Understanding Engineering Intent with AI Part 1 – Transcript

I recently had the opportunity to speak with Richard Barnett about the ways AI is helping sift through the massive volumes of data generated in the electronics industry and understand the engineering intent in the market. Check out the podcast here, or keep reading for the full transcript.

Spencer Acain: Hello, welcome to AI Spectrum I’m your host, Spencer Acain. In this series we talk to AI experts all across Siemens about a wide range of AI technologies and how you apply it to different technologies. Today I’m joined by Richard Barnett, chief marketing Officer for Supplyframe. Welcome, Richard.

Richard Barnett: Hi, great to be here.

Spencer Acain: So before we jump right into this, can you give us a little bit of your background and the kind of work you’re doing at Supplyframe?

Richard Barnett: You bet. I very much am pleased to be the serve as the chief marketing officer at SAS, sales leader for Supplyframe. And as many may not know, Supplyframe was fairly recently acquired by Siemens Digital Industry Software in August of 2001. So we’re very much excited to be a part of not just the digital industry software family, but the broader Siemens family globally. And it’s been a very exciting time.

Before I joined Supplyframe as the chief marketing officer, I’ve really spent my career really focused on where technology innovation meets with transforming business process and really delivering significant high value impact in different areas. So I’ve been a sucker for understanding typically very complex areas like global supply chain, procurement sourcing, trade promotions management. A variety of these topics, how new business networks that connect companies across their value chain, and really how to think about those intersection points around innovation, how to communicate and translate the innovation to real business value, to real impact, and really help to guide organizations, software companies, our customers, through oftentimes digital transformation to kind of think holistically about how do you take advantage of these new capabilities and really embed it and make it a living exciting change that everyone that’s impacted either inside the enterprise or across a community of ecosystem of partners can take advantage.

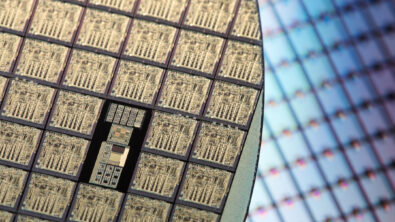

And Supplyframe and Siemens is just another really interesting inflection point right now where we’re seeing this convergence of data at scale outside in market intelligence and access to a lot of insights that if we can translate it and put it at the point of decision, it’s very transformational, particularly in light of the global component chip shortage and the broad supply chain disruptions that we’ve all been sort of on the front lines witnessing in the last two to three years.

It’s a really exciting time to be in the industry and the space and for me it’s a great opportunity to translate, filter, synthesize, and understand how to take all the great capabilities that Supplyframe and Siemens overall has. And think about it in terms of how do we communicate message, bring others on board, innovate and even imagine the future possibilities of what’s possible as we go continue through this innovation wave of really addressing how do we shift left, how do we apply AI and insights and help companies become more resilient. So it’s really what we’re doing right now and it’s a very exciting time.

Spencer Acain: So I mean that sounds like you’re really got your fingers in a lot of pies here. And you’ve got your… Or I maybe should say, got your finger on the pulse of technology here and you talked about being at the forefront, at the cutting edge of technology with big data, with all of this stuff. So how are you leveraging AI in this and how are you using Supplyframe to gauge… I think I’ve heard this term of engineering intent versus consumer intent. Is that what you are you’re using here? Can you maybe give me some examples of that? Give me some explanation on that?

Richard Barnett: Yeah, I think it’s a great question. So first of all, just say when we talk about artificial intelligence and AI, we’re almost in another peak awareness of AI. Because we’re all seeing it kind of unfold just in the last few weeks and months around kind of ChatGPT and new forms of thinking about DALL-E and computer vision, et cetera.

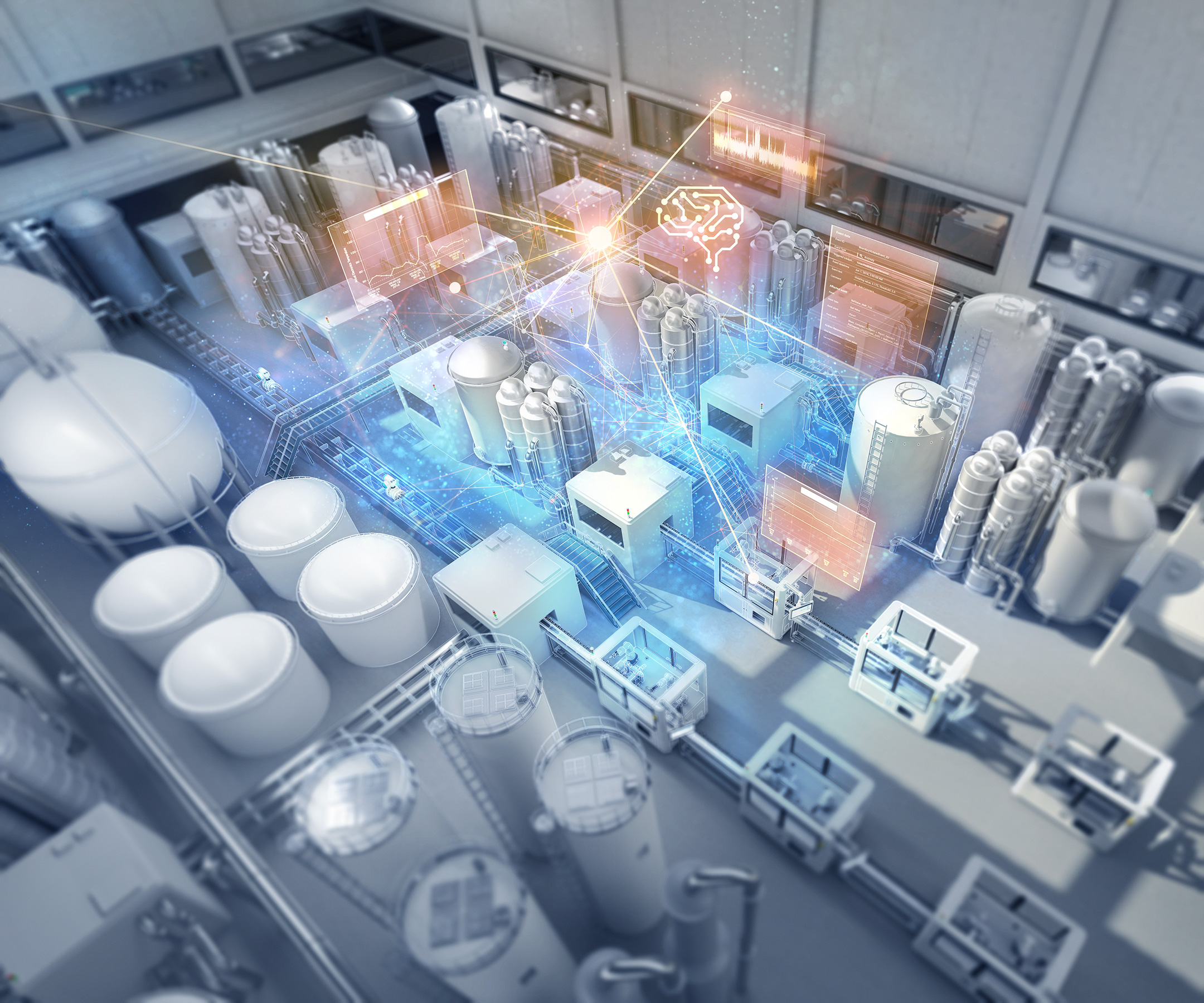

It’s really kind of spilled over into all of our experiences and we’re at this another wave of re-imagining, “Okay, what is the impact of AI? How does it make a difference in our world in different ways?” And when we think about artificial intelligence, we really think about different AI methods or techniques that are part of a broader portfolio that companies have been exploring and using in different ways. And we’re really focused on applied AI in this ecosystem of the electronics value chain and the processes globally of companies increasingly designing in their hardware, software solutions, applied electronics hardware design, whether it’s board or system level design to build a digital experience or build a connected device.

And we’re seeing this electrification of almost every downstream industry at some level that’s taking advantage around these electrification or capabilities that are really at the core foundation of lots of transformational potential experiences for consumers or really delivering really interesting value in sometimes very old school industries that are being transformed.

And so Supplyframe really grew up in the electronics industry at the heart of it, 20 years ago we just celebrated actually our 20th anniversary this year, which is exciting. And from the very beginning, Steve Flagg, the founder and CEO who I have the joy and pleasure of working with, was always focused on how do we create a more intelligent experience and digitally transform everything that goes on in the electronics value chain from the way component suppliers, semiconductor companies and even distributors engage and provide the right technical content, the right engineering insights that engineers, design engineers, component engineers in companies that are designing these hardware solutions. How do they understand all the information that they need to design and select the right components which are increasingly in complex? And there’s many, many options to consider.

The density of products have increased 20%, 30% in terms of the average number of components, lines on a bill of material just in the last three to four years. A tremendous amount of complexity, a tremendous amount of challenge. But the mission from the very beginning was how do we connect the experience around how do you design components, how do you source and buy them with greater intelligence either around supply market intelligence, around lead time and cost? Greater visibility around options for alternates, alternate suppliers so you can de-risk those products and make it a more connected, faster efficient way of responding to new market opportunities or risks all across the value chain. That’s really been our kind of core vision and approach to the market.

And what’s happened over 20 years is that the company has built out a network of different websites that inform engineers on vertical search. They’re looking up a new part or component that they’re going to use, they want to know everything about it from an engineering perspective, but their procurement supply chain teams also want to know everything about what’s the cost, what’s the availability, what’s the inventory. So we built up websites that help those engineering supply chain professionals search and understand this information.

We also built up community sites that exchange and share information around innovation or communities around specific end applications and new emerging categories. And sometimes it’s geographically based. We have the largest community of electronics engineers in China that all come to a website that shares the latest and greatest news and content and showcases innovation. And you also have models and technical content that engineers download at the point of design.

So we’re seeing and sensing what’s really going on in over 2.5 million new hardware designs annually. And we’re looking at all of this content and connecting into over 80 APIs that are real time APIs with distributors and component suppliers. And we’re constantly monitoring something like 600 million parts globally. So all of this, we call this design to source intelligence network.

And the challenge and the opportunity around AI is when you have this incredible network of data and digital exhaust that’s being created constantly every day by 10 to 12 million users across almost every player in the electronics value chain, every supplier, every engineer that’s in different industries, whether it’s automotive or consumer electronics, it’s all there. So the opportunity is how do you make sense of all that engagement? What new intelligence can you bring to the surface? We call it kind of the digital exhaust, it’s the fingerprints, it’s the patterns, it’s the activity that’s constantly evolving. How do you make sense of that in new ways?

And that’s really where applied AI becomes really interesting because first of all, you’ve got to normalize and build an aggregate sort of industrial data scale model that’s very heterogeneous. I mean you’re getting information, you’re managing structured data, user engagement behavior. You’re making inferences around patterns, around clusters of design or geographies or application component engineering sort of patterns. And you’re trying to, “Okay, we’re going to aggregate this, we’re going to look at this in patterns and understand and predict market trends, whether it’s around lead time or engineering design popularity.” For example. Or where based on design demand supply, lead time and inventory, maybe the market and a certain commodity group is going to go through another correction that no one’s seen. Or maybe we’ve got the early indicators of what’s going to happen in automotive months before the automotive OEMs actually sensing or understanding the impact that’s coming their way because we know everything happening at scale, but also across multiple tiers and ecosystem community participants in a way across the entire value chain.

And so what what’s been exciting for me personally is seeing how Supplyframe has constantly evolved and constantly creating and identifying new insights, new derivative insights that were never possible to see or understand before. And you talked about engineering intent versus consumer intent. This is an area that I saw happen in kind of other market segments in a different way, but very similar going back probably to the 2012 timeframe is where you saw this emergence of new ways of sensing demand or demand sensing consumer behavior where you might look at consumer categories for food and beverage or even for sort of fashion, for example.

And the application to technologies was how do we understand a better way of predicting demand or intent of those consumers based on all sorts of different attributes better than the old school way of forecasting sales and relying on past sales histories to predict the future? Because it’s remarkably inaccurate.

And what happened at that time was, you saw innovators bringing together really disparate data sources and then correlating it and then building new models to understand prediction around things like, “What if you were going to do a promotion for hot dogs and beer and chips for an end-isle display in grocery store chains across the United States around say July 4th?” Because I’m a July 4th baby, so I’ll just use that as the example. Wait, weekend. Well, what if you knew weather patterns? Well, that’d be interesting, right? Because not everyone’s going to have an outdoor barbecue if it’s raining. What if you could sense and get a sense of what was popularity wise from a brand or from a digital engagement, what was the most popular emerging shifts in regional likes on say Facebook or another social media around a brand offering? Whether there was a new beer that was being introduced to the market.

And you took all your historical data and you knew what the patterns were seasonally in general, and you pulled all of that information together. Now you’re doing something really interesting, you’re really getting the pulse or the beat on this very maybe complex system, but where this consumer intent is going to give you a better idea of any kind of promotion or sales activity, et cetera that might be happening if you pulled all together and then you train and learn those models around-

Spencer Acain: It sounds like you’re making a very holistic model in that. Just bringing in all of this stuff together to… Stuff that maybe you wouldn’t even think about. Like you say the weather for example, you don’t really think about how much people are going to buy chips when just because it’s going to rain or something, but there is a correlation and then you’re kind of getting it to the heart of that then.

Richard Barnett: Right. Exactly. And so really interesting work has been done in that area for a long time, and really broadly in supply chain management around demand planning, demand forecasting, promotions, management, et cetera. It’s really the leading global brands have really adopted some of these approaches and had great results.

Now, when you switch gears though, and you look at, okay, engineered products, discreet manufacturing with engineered designed products, particularly electronics, where you have this incredible complexity, it is no one has surfaced and really got a handle on engineering intent because if you think about it’s totally different kinds of signals around what drives engineering design decisions than consumer behavior around whether they’re going to go to the barbecue on the weekend. But as a pattern you can say, “Yeah, okay, we can think about this holistically.”

And what you start exploring is, “How understand and correlate the dynamics between what engineers are searching for…” Maybe on websites that are dedicated content sources like findchips.com, which is in the Supplyframe’s portfolio, one of the most popular global sites for engineering design research, “As well as looking at demand on distributor websites of what key components are being purchased right now.” You know what I mean? And particularly in this global chip shortage, that’s been super challenging because a lot of these part components went from 4 weeks, 6 week lead times to 52 weeks, 60 weeks, 70 weeks in some cases.

So everyone’s scrambled to try to figure out what we call chasing parts. But that’s that by itself. All of that activity is super indicative of where there might be new choices for alternate parts components that gives you a new set of insights. And then you can start looking at, “Okay, what are the design decisions where companies or engineers are downloading models and putting them into their CAD environment?” Well, that’s almost like a real time signal for true design in decisions because if they’re building a model and putting it for a component or part and putting it sort of design environment that’s giving you the earliest visibility of new hardware designs as they’re being created and you pull this data as well as many other kind of data feeds together, and you start getting this composite picture of, “What the design intent is both right now by…” And you can cut it in different ways, “By geography, by similar parts or categories of parts or components or by end application?”

What’s happening in automotive is obviously going to be different from industrial consumer, but they could be designing it and using the same components just for a very different application. So there’s a lot of complexity there, but if you can distill the noise and you can start surfacing what’s the most relevant composite index view of that intent, then you have something that’s really special because if you can align intent with the companies that are trying to service the needs of those engineers, gives those companies better visibility into what the best mix of their new product introductions might be based on what they’re seeing as not just sales revenue or commitments on active orders, but where the market might be going in 18 months to 2 years. Because the typical design cycles for new products vary by industry, but they could be as short as three months for something just kind of fast moving, or could take three years or four years in the case of automotive or aerospace and defense.

But if you can sort through, you have this early indication of the best view of real market demand, in this case engineering intent and those design decisions that they’re making increasingly very complex, then you can start actually aggregating that information and comparing it across not just engineering design popularity, but then think about doing the same exercise for understanding all the leading indicators for lead time, for price and cost changes, for demand that it’s more near term around ordering behavior. And you can get enough relevant insights across the entire electronics value chain.

Then you can start building a holistic model that correlates each of these into indices, which then, as a composite, give you the best triangulated view of what’s happening in the market and in this market environment that we’ve just been through, having a predictive accurate view of what’s not just happening today or what happened last month, but a reasonable predictive view of what’s happening over the next 2 to 3 months in the near very near term, and maybe a longer term view of what’s happening maybe over the next 18 months is just gold.

Because in this industry, if you think about the economic impact of what the global component shortage has created, Goldman Sachs, McKinsey, AlixPartners, the automotive industry, different studies have been done, but broadly speaking, it’s over a trillion dollars of lost sales revenue that’s impacted over 169 discrete industry verticals globally across 200 countries.

And that is non-trivial, I mean, this is a once in a lifetime economic impact. Not everything supply shortage related to COVID because there’s multiple supply chains that were massively disrupted. This is directly related to the impact of the shortages and demand mix changes and all the volatility that was created in a very short period of time just for electronic components. And that means that we’ve all got to get better about managing and predicting, getting ahead, or sometimes we call it to the left of these problems over time. And applied AI around this very unique set of data and information that Supplyframe has in its network is a really exciting way to deliver value to everyone who’s been struggling in the near term.

So anyway, that’s a very broad overview, but to me it’s very interesting because Engineering 10 is a key component to getting your hands wrapped around what’s happening, what’s going to happen in the future.

Spencer Acain: Yeah, I mean, it sounds like you’re dealing with a very complex series of issues here and equally massive amount of disparate data from all sorts of… Like a huge web of connected suppliers and conditions too. With that, though, we are out of time. Once again, I have been your host, Spencer Acain, and this has been the AI Spectrum podcast. Tune in next time as I continue my conversation with Richard Barnett on the applications of predictive AI.

Siemens Digital Industries Software helps organizations of all sizes digitally transform using software, hardware and services from the Siemens Xcelerator business platform. Siemens’ software and the comprehensive digital twin enable companies to optimize their design, engineering and manufacturing processes to turn today’s ideas into the sustainable products of the future. From chips to entire systems, from product to process, across all industries. Siemens Digital Industries Software – Accelerating transformation.