The Semiconductor Shortage Explained

The semiconductor industry is a crucial component of today’s global economy that finds itself weathering intense, prolonged stress from dealing with severe shortages. And it’s far from over.

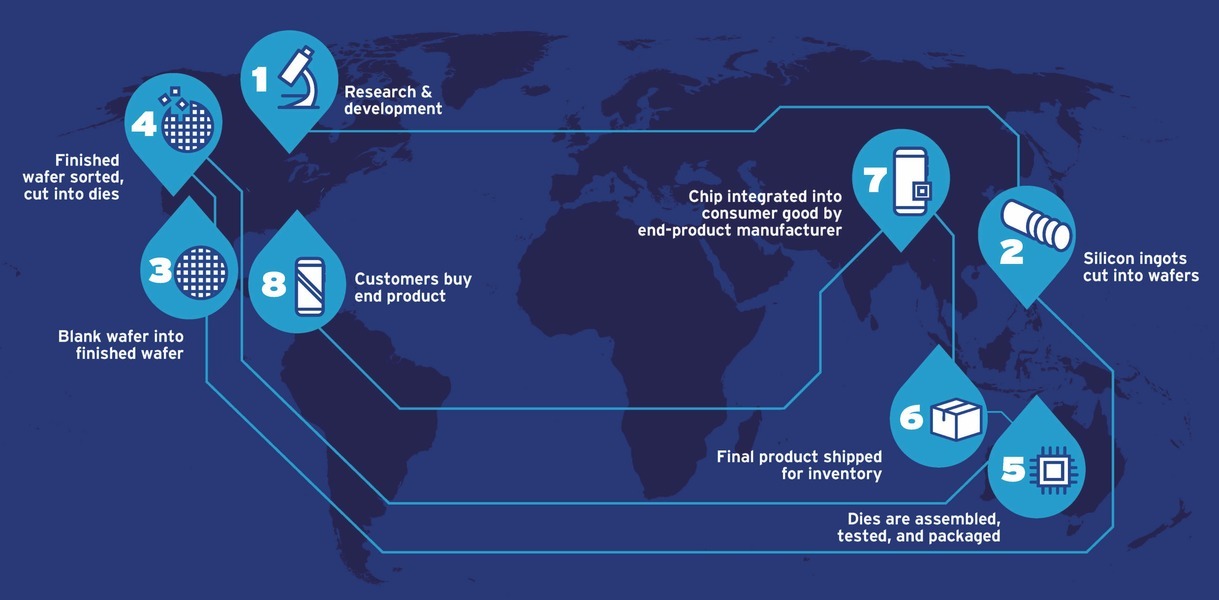

Even in the best of times, there is no shortage of obstacles for chipmakers, due to accelerated innovation, a complex chipmaking process, and a geographically dispersed supply chain. Factor in recent disruptions to the supply chain caused by the global pandemic, plus surging demand due to expanding digitalization, and the increased use of 5G, and you have an industry involved in a difficult transition that is affecting many other industries.

Understanding the story behind the headlines is important, as it is essential to finding the way forward.

Why is there a shortage?

Technology professionals understand that the microchip shortage was initiated by the COVID-19 pandemic, which caused a massive buying surge for laptops and other electronic devices needed by work-from-home staffers and students being home-schooled. Yet that was only the beginning. It was followed by a perfect storm of complicating factors that converged on the semiconductor industry almost simultaneously. After the pandemic’s initial surge came a super cycle* of demand for chip upgrades driven by waves of new technologies, including new 5G networks, expanding cloud services, and AI services. At the same time, global lockdowns were causing labor shortages that forced chip production facilities to shut down, further depleting inventories. Even the weather got involved, with a severe draught impacting the water supply which affected chip production in Taiwan. In addition, the ongoing trade war, including U.S. sanctions, put a squeeze on the supply of advanced chips in China. All of which was just too disruptive for the industry to absorb. But it didn’t stop there.

Which industries does the semiconductor shortage affect?

Since microchips are used to run countless devices that run the modern world, the shortage soon affected many other industries, including the global auto industry, consumer electronics, appliances, LED lighting, gaming, solar panels, turbines and many more. According to consulting firm AlixPartners, the global auto industry alone is projected to lose $210 billion in revenue during 2021.

How does this affect the supply chain?

The fact that the supply chain is disrupted by the pandemic is not surprising. There are many current and potential future disruptors we are dealing with – from volatile shipping economics to shortages of raw materials and labor to climate change and de-globalization to shifting demographics and technological advancement – all of which indicate that new supply chain strategies are needed.

The Siemens Valor blog recently reported that before the arrival of the pandemic, the average cost of shipping a container was $2,000 – $5,000. Today, shipping the same container often costs close to $30,000, but there is no guarantee that it will arrive on schedule.

Delays in shipping have caused acute shortages of raw materials such as the compounds used in medications, plus metals used in manufacturing, and other essential materials. Not surprisingly, these shortages in raw materials have caused a steep rise in the components they are used to produce.

For example, in August 2021 chipmaking giant Taiwan Semiconductor Manufacturing Co. announced a price increase for all their chips of as much as 20%, and other chip manufacturers are following. As a result, manufacturers must either raise the prices of the final goods, which could result in reduced sales, or reduce their profit margins.

Research from Siemens Advanta – Siemens’ digitalization consulting arm – found that 73% of supply chain leaders say they’ve encountered problems in their supplier footprint that will require changes in the future. Even market leaders like Amazon are making strategic changes to expand their own logistics organizations to bring more of the process under their ownership and management. As more and more companies try to find ways to manage supply chain volatility, we expect many other changes to occur.

Across the semiconductor and electronics supply chain, prolonged delivery times persist. According to Siemens Chief Executive Roland Busch in Reuters Business News on May 7, 2021, Siemens is working hard to reduce risks from electronics bottlenecks, while foreseeing shortages ahead in steel, plastics and freight capacity.

How long will the chip shortage last?

According to the Commodity Intelligence Quarterly (CIQ) report from electronics supply chain analysis firm Supplyframe, now part of Siemens, the shortage of semiconductors could stretch into the first quarter of 2023 to hamper production of technology-dependent products like automobiles.

What is being done about it?

According to a SupplyFrame update in September 2021, automakers are now collaborating directly with chip makers to strengthen their supply chain for the future, while currently making tough choices to remove some features from their vehicle lineups in an effort to reduce chip usage.

In addition, suppliers like Intel are making substantial new investments in growing chip capacity. Governments are also getting involved, with pending legislation such as The CHIPS for America Act, which proposes income tax credits to help spur new semiconductor equipment and manufacturing facility investments in the U.S.

What does the future look like for the semiconductor industry?

With surging demand, the future looks very bright for the semiconductor industry, although change is certainly coming. Due to the weak links exposed by the pandemic and its aftermath, we can expect to see many adjustments to strengthen a supply chain in need of greater collaboration and capacity.

Can the industry gain anything from this current challenge?

How do we ensure supply chains are reliable in this new normal to create a more resilient future?

In an October 18, 2021 interview with Yahoo! news, Siemens USA CEO Barbara Humpton, discussed how the regionalization of manufacturing can help the current supply chain bottleneck. “We have been in a couple of decades of globalization,” Humpton observed, “But what we absolutely need is the ability to make products close to the source of demand. So this regionalization of manufacturing is actually going to help make our supply chains more resilient. And Siemens is playing a role with our technology.”

Optimizing supply chain collaboration is now more important than ever.

As the current microchip shortage illustrates, integrating the entire supply chain for greater collaboration is more critically important than ever for today’s semiconductor companies. And Siemens product lifecycle management (PLM) is the one solution that integrates all of your key players in semiconductor product design, development and manufacturing across the entire supply chain to optimize the product lifecycle process from concept to delivery. All of which enables teams to reduce mistakes to design products right the first time, reduce costs, improve operational efficiency, reduce waste and improve time-to-market. And when combined with our Calibre IC manufacturing solutions, you gain accurate, efficient, comprehensive IC verification while minimizing resources and tapeout schedules. And more.

It is clearly a solution for these times. And beyond.

About the author Sankhajit Chakraborty

Director, Global Electronics and Semiconductor Industry Solutions, Siemens Digital Industries Software

Chakraborty has more than 25 years of leadership experience working for multinational companies in the semiconductor and electronics industries, notably, Toshiba, Intel, ON Semiconductor, Atmel Corporation, and Broadcom, leading multiple PLM, supply chain, and manufacturing systems implementations.

In his current role, he provides architectural oversight, a broad solution view, and market value definitions for the development of new or enhanced product capabilities, best practices, methods, tools, and solutions to ensure customer and industry alignment with the Siemens Xcelerator portfolio.

Chakraborty has a bachelor’s degree in electronics and telecommunications engineering and a master’s degree in computer engineering and artificial intelligence.