5 Automotive Megatrends

In a recent blog I speculated about Apple’s business model for mobility, and stirred up a hot nest of opinion. Mostly agreeing with the assertion that there is a bigger picture beyond a hunk of metal. Media reports since then saying that Apple is moving away from designing a car, and focusing more on the underlying software platform makes perfect sense. Some of my colleagues suggested Tim read the blog and then decided to change direction… then again I do work with a few comedians.

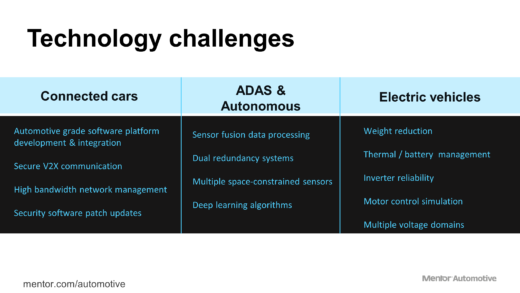

We see the term new mobility becoming a catch-all for everything happening in connected, autonomous, electric vehicle development. It’s too broad a term to describe the future, we need to drill down a level. We have to look beyond automotive today, and see where industry technology convergence is taking us, and identify the megatrends. Here at Mentor Automotive, we have identified 5: Connected Car, Autonomous Drive, Electric Vehicles, Mobility on Demand, and Smart City.

We have blogged about these trends individually in the past, highlighted the significance for automotive software platforms, vehicle electrical and electronic architecture, and the role of power electronics. But it’s interesting to align these megatrends with the core technologies and investment areas of the new automotive supply chain, and see what the roadmap of mobility could look like (and go ahead and pick your own megatrends, align them to any computer company’s technology and see where it takes you, and please share).

So, what is the new automotive supply chain? Traditionally it has been car makers sending a spec to a tier 1 for some ECU, the tier 1 then designs the hardware and software and integrates it. High value activity. But look at the new automotive supply chain: we see investment money from telecoms, network infrastructure, cloud computing, big data, AI & deep learning neural networks, and consumer technology companies. And governments.

This investment money is chasing the new automotive revenue pool, estimated by McKinsey as $1.5 Trillion recurring additional revenues by 2030, from shared mobility and data-connectivity services. This drives increasing investment as new entrants try to get first mover advantage. And the new supply chain is already seeing an ROI — in Q1 this year, 1/3 of all new cellular subscriptions in the USA were cars. This is not Bluetooth-tethered, this is embedded cellular in new cars.

Electronics and software is driving the majority of the innovation, and where the majority of the investment money is going. EE architecture and automotive electronics systems are projected to be 50% of total vehicle cost by 2030. The wiring harness has been quoted as being the heaviest component after the engine and chassis. Electric vehicles can have multiple voltage domains beyond the standard 12V, and the higher voltages need heavier gauge cables, adding weight, and thus challenging range mileage. Automotive electronics now defines complexity.

Of course the long-term growth vector in automotive is on-demand services. Katy Huberty at Morgan Stanley has taken a shot at estimating the shared mobility market, and suggests it will be worth $2.6 Trillion by 2030, the math being 26% share of 20 trillion total miles driven, at 50 cents a mile. As a rough swag, that sounds reasonable to me, a quarter of all miles driven being on-demand purchased trips. How that stacks up with the McKinsey number could be debated, but the common message is: we don’t know exactly how big the market will be, but it’s likely to be measured in $ Trillions.

As we bring these new applications to the mass market (and across the fleet), we see challenges in development; how to productionize something that was originally brought to market on an Mercedes-Benz S-Class has different challenges when applied to a Ford Focus, where margins are tighter. Consumers expect more features with every new platform release, but have also been conditioned that this is evolution and they don’t expect to pay significantly more.

So we have a perfect storm of new mobility technologies brought to market, with significant engineering complexity, and tight R&D budgets. This means finding new ways to address the complexity, and increase productivity of those R&D dollars: either by partnering to bring expertise in-house, or adopting new design tools and production-grade reference platforms to reduce development cost, eliminate design errors, and speed up project cycle times to hit that first-mover advantage.

Since joining Mentor Automotive I often get asked, ‘so what do you folks do?’ Well, this is what we do. Starting with the megatrends, and all of the above.

Comments

Leave a Reply

You must be logged in to post a comment.

CaaS is much bigger but at a much lower cost per mile. The goal has to be 5-10 cents..The number of miles increases by a lot vs today due to the much lower costs. Unless the numbers you quote are US only.

The 6th trend is small vehicles. Bikes, Segways , scooters and more as cities need to reclaim the land lost to cars. Cars are extremely inefficient . Electric, autonomy and CaaS do increase efficiency by quite a lot but it’s not enough.

Thanks for the comments, the data presented by Morgan Stanley was worldwide, but as you say this will likely be bigger as the market drives down the cost per mile. Small vehicles and new designs, stacked parking etc are absolutely coming I agree, we capture that trend under Smart City

In Europe where gas prices are very high, CaaS could be cheaper than the cost of gas today.

Take a car that consumes 8L per 100km in Germany and you end up at some 0.12USD per km fuel costs.

Take a 24-36k $ electric car with depreciation at 3 years, assume 40km/h for 16h per day (would also do deliveries to optimize utilization), that’s 640km per day and depreciation per km would be 0.034-0.051 $ per km. The service provider could generate it’s own electricity with solar or wind farms at lets say 5 cents per kWh (maybe a lot less given the timing), the car could use 200-300W per km, so fuel costs at 0.01- 0.015$. Maintenance and operating the fleet are harder to estimate but high efficiency could be reached if the car is designed to be cleaned and repaired by robots. Margins at 20-50% and the price consumers would pay is very interesting.

After 3 years ( depreciation was 3 years), refurbish the car and move it to developing markets to reach much lower costs.

Battery costs will come down, sensors and computing will get cheaper,renewable energy is bound to get cheaper, cars might get smaller or at least lower weight so, with some luck, costs can get significantly better in 10-15 years.