Glocalizing battery production – The Battery Podcast S01E11 – Transcript

For episode eleven of The Battery Podcast, we aired a discussion from Hannover Messe 2024 on the localization of battery production in a global market. Listen in or read along to learn about how KORE Power is bringing production to the US.

Nick Finberg

Welcome to another episode of the Battery Podcast from Siemens Digital Industries. For this discussion on the glocalization of battery manufacturing, we are sharing a panel discussion from our booth at Hannover Messe. To talk about how companies are meeting net zero goals, our host sits down with the CEOs of Kore Power, Siemens Financial Services, and of Smart Infrastructure at Siemens. This is a great example of how Siemens helps get innovative companies off the ground with not just funding, but experience and expertise. We hope you enjoy!

Christine Brunner

With a big hand of applause, welcome our three guests on stage. Lindsay Gorrill, Veronika Bienert and Matthias Rebellius. All right. Hello, everybody. Great being here. So let’s take a seat. – Sure. – Whoo! – Excellent. – I’m gonna do a quick introduction round. So for all those who don’t know, our VIPs here on the stage yet, will know that. We got you, Lindsay. You are the CEO and co-founder of the US-based and all-American battery production facility, KORE Power. KORE with a K, but it still stands for a core, right?

Lindsay Gorrill

The middle of everything, basically.

Christine Brunner

That’s where the heart beats, actually. It brings energy everywhere.

Lindsay Gorrill

Exactly.

Christine Brunner

Okay. We got Veronika Bienert. She’s the CEO of Siemens Financial Services. And Siemens Financial Services is more than money, right?

Veronika Bienert

Absolutely.

Christine Brunner

Okay. And we got Matthias Rebellius. He’s our member of the Managing Board and responsible for smart infrastructure, and he’s the CEO of that division. All right. So I guess you’re doing good. Second day at the fair. I mean, we see a lot of visitors here and we have lots of technology, but we also have lots of solutions. And now I’m coming into the game. Colleagues just said before, it takes the right recipe to make a cake, a dessert. And I’m going to focus on three key ingredients now that we want to talk about. It’s technology, it’s financing, and what we call a broader ecosystem collaboration. First, Lindsay, I’m going to talk about the collaboration with Siemens, but you first should share a few facts on what KORE Power is. And from what I understand, as I said, you’re the US-based, and this is very special because when we think of battery production, we think of China. You produce your batteries provider of cells, batteries and solutions in the US.

Lindsay Gorrill

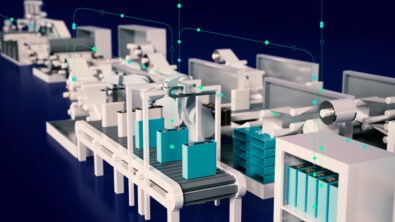

Yeah, thanks. Yeah, so KORE Power, US private company, kind of my brainchild, that was actually part of the supply chain for lithium batteries. My last company, mining company I sold nine years ago was in the supply chain for lithium batteries. I had this idea that we should bring the technology to the United States. And so KORE Power, from that, we basically produce cells all the way through to modules. We do all our integrated software from module to EMS, and we actually produce solutions. We actually produce final energy storage solutions.

Christine Brunner

And how did it come that you partnered up with Siemens?

Lindsay Gorrill

So we met Siemens Financial about a year and a half, just over a year ago. And what’s been phenomenal is working with Veronika’s team has been amazing. They were the lead financing group that gave us the catalyst to break ground on our plant in Arizona. So we broke ground on the first phase of our 15 gigawatt-hour plant in Buckeye, Arizona. And on top of that, you know, it’s… I’ve dealt with finance companies all my life, especially building mines, it’s pretty difficult, right? But this is more than just a finance company that gives you the money and walks away. The integration with us and Siemens has been unbelievable.

Christine Brunner

We like to hear.

Lindsay Gorrill

No, it’s been good. And I think the telltale is three parts, I would say. The first part being, you know, KORE is growing exponentially. Like, our numbers are growing crazy, right? And having… We have two members of Veronika’s team, Jason Thompson, who’s on our board, and Billy Maloney, who’s basically an advisor. And they’ve helped a lot in giving us advice as we’re trying to expand this company. The second part of it really is the customer side. So Siemens is a customer of ours. Plus, on top of that, Siemens has brought other companies you’re involved with who are customers of ours now. And the third thing is product, right? We are using basically the innovation technology that you see here in our plant, and also some of the infrastructure, mission-critical infrastructure in our plant. So it’s been a phenomenal partnership with Veronika and the Siemens team.

Christine Brunner

All right. That’s good to hear, and I really love that, and we’ll deep dive on that a little bit later on in detail. Veronika, when we think of energy transition, we think of technology usually. It’s not that financial sides are being considered to be the catalyst for this. Can you allude on this a little bit in more detail on the larger role of finance, which it has to play in that project?

Veronika Bienert

Pleasure. So I think first referring to the partnership we built together in the course of the last one and a half years. And I think what is very important to understand is that in the first financing tranche for your undertaking for your facility, KOREPlex, so we really started as a lead investor here. And… but it is not only being the lead investor, but you already mentioned that really to take an active role, not only on a board level, but really when you need to make certain decisions, really risk-taking from a financial side, really how to from an entrepreneurial perspective, how to drive this company forward, that is something how the teams really built this very close partnership. And this is really the foundation for much more. And to take it really from a much broader perspective, we talked about that just yesterday. We are really facing an era of transition, transition in the energy space, transition in the infrastructure space. And in such a decade of a climate action area and era, so we really need to tackle that from a different perspective. And Matthias, you will refer to that. So innovation and technology will make a difference, but very often access to financing is really essential to drive the innovation and to lower the entrance hurdle for innovation. And that is really a very important area which we are driving. And just to consider how huge the investment need is on a global basis. So just for Germany, till 2045, to reach climate neutrality, an investment just in Germany of 3 trillion euro is needed according to current studies. So there is really much to do in this environment. And from our perspective and the experience we made over many, many years, only the very close collaboration from your side, from an entrepreneur perspective, and then really combining the technology know-how and the financing know-how, that really is making the difference.

Lindsay Gorrill

It’s important.

Veronika Bienert

Absolutely.

Christine Brunner

So SFS is making the difference. Talking about the technology, Matthias, it’s often said that digitalization is the only way to really accelerate the energy transition. And of course, to meet zero, net zero goals. That’s the topic here, sustainable. By the same token, I’ve heard you say that we’re also in the era of infrastructure transition. So what does that mean and how do these two intersect?

Matthias Rebellius

I think those two things don’t go without each other. And the batteries embedded in production, what Lindsay is representing here, is in the middle. It’s really where those two transitions meet. And a lot of money is also needed, so it’s good to have SFS and Veronika involved. From a technology perspective, we have to look into… When we talk about the energy transitions, of course, about increasing renewables around the globe, because all of the electrification, all electric world isn’t worth anything if the power is not coming from renewable energy. But we are far away from where we’re supposed to be globally. When you have the energy, then you need storage batteries, and you need the batteries also for making the EV, electric vehicle, a vision to come true or become a reality. So that is important. All of this is driving complexity, complexity in the infrastructure, be it in buildings, in electrical grids, in the electrical infrastructure. And everywhere where you have to manage a huge amount of complexity, you need digitalization to take a layer of complexity away and enable us to make better decisions. And that’s why we are driving, and you see it here also on the booth, with accelerator offerings driving digitalization to support the energy transition as well as the infrastructure transition.

Christine Brunner

All right. Now, infrastructure, I mean, you will be supporting lots of vehicles to be on the road. You started KORE Power a couple of years before the pandemic, stoked and turned the world upside down, and especially really had severe disruption on supply chain. What were some lessons which you learned in that time, and what kind of shifts have you seen in the public and governmental perception for the importance of on-shoring projects?

Lindsay Gorrill

Sure. So I think with my background, I already understood the supply chain issues before the pandemic, but I think the pandemic opened the eyes to everybody up about some of the issues we have. And I think, again, we go back to the question KORE. The reason we say KORE is because the cell is the center of everything. I get a lot of questions asked to me all the time. Why is there no supply chain in the United States? Why is there no supply chain in Europe? Well, if you don’t have a customer, you can’t have a supply chain. And the cell is the customer, right? So we’re the customer. So we spent the last three, almost four years working on onshore on our own supply chain. So we have agreements with five different companies now that are going to build plants in North America that will supply our production of our KORE plants. So I think, you know, this pandemic was a bad thing, but I mean, it opened the eyes to some of the issues going on. And I think it’s really important as you push forward and making sure that you understand what the supply chain is, what the needs of the supply chain are and how do you… And if you focus on it, it can happen in five years. I think you can be there in five years if you focus on it.

Christine Brunner

Sounds great. And in regards of circular economy, you want to put some phrases in here as well?

Lindsay Gorrill

Well, I think obviously with us, the sustainability is big, right? So we spend a lot of time on our recycling side and that kind of side. Also, on top of that, our products are in all aspects of energy storage. We have EV customers. We don’t deal with the big guys. We have EV customers. Our biggest business is energy storage. So we, again, we said earlier, we sell in to 44 countries. So we’re into energy storage all over the world.

Christine Brunner

Okay, you are the heartbeat of power distribution, so to say. Veronika, Linzay already alluded that it was a great partnership from the beginning and financing of Siemens was the catalyst to really start that project. So SFS is more than just money. SFS is more than money. You’re the orchestrator, so to say.

Veronika Bienert

Yeah, orchestrator and integrator. So what we are actually showcasing together with KORE is a certain… Yeah, power play with regards to the building a broader ecosystem. I think that is what it’s all about. And so there are different parties involved. And you mentioned that already from your side. So it is really the perspective of supply, demand and investment. And really to orchestrate these three dimensions, that is really the important one. And then bring really different partners to the table in order to drive this transition. And I was mentioning as well the huge investment need, but it’s not sufficient just to have a private approach, a private investment approach. I think it’s as well orchestrating on a really a federal level, on a state level and a local level, different financing sources and to bring that together in order to accelerate in that area. But really coming back to this kind of ecosystem power play, what we are doing right now, since you are not only producing batteries, but you are serving different parties. So therefore, I think there is so much to do, what we can, for instance, facilitate as well in this broader Siemens ecosystem, talking about Siemens Energy alike and different partners which we are having. So you can serve them as well with your supply. And I think that is really a great potential going forward.

Christine Brunner

In regards of the ecosystem topic, I’m coming back to you, Matthias, now from the technology side. What are some of the challenges which you see battery factories might face?

Matthias Rebellius

I think Lindsay knows that much better. But from our perspective, first of all, it is a hugely complex process in an exponential growth environment, which is especially in times of difficult supply chains. Initially, you have to have raw material shortages, you have to manage about this and it’s about environmental conditions. So it’s everything you can imagine, it’s included. And so you have really a complex business, right? But you structure it well and we are supporting with our technologies and with the technical ecosystem. There’s a finance ecosystem and there’s the technical ecosystem where we have partners here also on our booth, partner of our Xccelerator technologies and business platform, supporting in the entire process. Be it also, of course, products and components from Siemens Energy, but across all of Siemens and external partners as well, supporting also the factory being built in Arizona. We have our digital enterprise equipment, of course, the PLCs and the software included. We simulate the production. I think it’s very important before you do such an investment and to be faster to fully simulate the manufacturing process and the plant. And you can also see this here and you have done it. And then it’s about safety environment and also the surrounding of the factory process also incorporates then the building and the infrastructure, not to forget the electrical infrastructure behind. This is where we come into play. So it’s a combination of everything we have to offer together with our ecosystem partners to try to manage your complexity as good as possible.

Veronika Bienert

Right, and you are as well contributing with the experience which you are having from an innovation and technology side to give confidence to new investors because you want to scale your business.

Lindsay Gorrill

For sure.

Veronika Bienert

And so therefore, I think this is really helping and supporting each other in order to grow your business in a sustainable manner.

Lindsay Gorrill

Yeah, exactly. The full production plant will be 2 million square feet. And we’re talking about net zero. So with us, with our own storage and we have 2 million square feet of solar is to build a net zero. And working with Siemens and all that has been very effective.

Christine Brunner

That’s great to hear. I’m going to go back to Matthias one more time in regards of battery factories and thinking of how important they are to think of e-mobility, to drive e-mobility. You for sure have some facts here with customers.

Matthias Rebellius

Yeah, I think it’s obvious. You know, if it’s batteries becoming important for the electric vehicle but also for the storage in the grid system. But just looking at the exponential growth in terms of electric vehicles with, you know, 25% of vehicles being predicted in the US to be electric until 2030. And also in Europe, there are, you know, 25% growth rates. And you see all these numbers. They’re just huge and big. And also making sure it’s underlying the amount of what is needed. So battery manufacturing, battery technology is a key driver for efficiency also in the entire electric mobility.

Veronika Bienert

Electrify with Volkswagen I think is one of the projects we’re big in.

Matthias Rebellius

Yeah, just in the US for example, if you want to go in the examples, we have cooperation with Volkswagen together with SFS as well in terms of Electrify America. So I think it’s the single largest public network of chargers where we are contributing with our technology and also in the similar model. And last but not least, also we spearheaded I think bidirectional charging with our Ford Lightning truck, the F-150 in the United States, one of the most favoured cars in the US. That we can use bidirectional charging, which means we use the battery also in the car as a backup power supply for the ranch or for the building, which is just one more showcase.

Christine Brunner

Great idea, really a great idea. And also US Postal Services, one of our customers. Think about like in the US, massive amounts of cars definitely you need to supply.

Matthias Rebellius

One out of many fleet customers that we have and also bus depots. So the amount is huge and the business is really growing.

Lindsay Gorrill

Yeah, and just looking at the vehicle side, it’s huge, but it’s the infrastructure, right? The infrastructure is almost as big with storage and backup, etc.

Matthias Rebellius

Yeah.

Christine Brunner

And now that we are focusing on the US and what’s going on there, I want to deep dive in the topic of the US Insulation Reduction Act and workforce challenges, which we are facing there, talking about manufacturing in the US. Lindsay, can you kind of allure a little bit in regards of what the goals are to restore domestic manufacturing and turn and boost job growth and the clean energy technology sector also will boost. How will KOREPlex support these goals of the US Inflation Reduction Act?

Lindsay Gorrill

Yeah, so I think we talked earlier about finance, right? And I think one of the things the US government did very well is first they came in with the Infrastructure Investment Act. That came in pretty early. That’s a massive amount of money invested in infrastructure in the United States, not just our space, but a lot of the space that’s required. And then on top of that, they came in with the IRA. And the IRA is basically a 10-year program, which I think is important because it allows private funding to come into an industry you need private funding to come into with less risk, right? So if you stack up your three levels of production or three levels of the IRA as it relates to our business, the first two are the 10% production credits. So on the mineral side, we’re involved with companies to develop that. So they get 10% production credit. Then you’ve got the next stage of downstream, which is your chemical and your process, which gets that. And then that flows into us, the manufacturing cell, module manufacturing, that you get basically $45 a kilowatt-hour credit. And that’s big. That’s massive. And then on top of all that, because we qualify, our customers qualify for the IRA, you have incentives on both sides, on the EV side up to $7,500 per vehicle. But on the ESS side, it’s 30% for the first time on ESS. So that, I mean, the market was already growing exponentially already. This is just… Blew it up.

Christine Brunner

Blowing up.

Lindsay Gorrill

Bad word. Sorry.

Christine Brunner

Not literally. Not literally, please.

Lindsay Gorrill

Yeah.

Christine Brunner

Okay. Going to you, Veronika, you touched on the importance of private sector financing working alongside the public policy. How do you see the value of the Inflation Reduction Act?

Veronika Bienert

So I think it’s a huge opportunity. It’s a huge stimulus program in the US, and it is bringing focus on the investment needs in order to drive the sustainability innovation. But I would say it is not only a US topic. I think it’s a topic which is really needed on a global basis and in different economies really to drive sustainability. And we from Siemen’s side, whether it is from technology or investment or lending side, we are of course on a global basis supporting our customers on their sustainability and on their journey, because it is about really relocating and diversifying the production side. I think that is what it is all about. And we are capable to do that in order to support our customers where it is needed.

Christine Brunner

Words. That’s a great phrase, because we’re about to wrap up our session here on stage. So I’d like to give like a last few words from each of you in regards of the chance of glocalizing sustainability products that they’re having. Okay, I’m just hearing we have a bit more time than this. We’ve got to finish some technical topics here, so we’ve got more time covered. KORE Power.

Lindsay Gorrill

I’ll go back to your employment question. That’s critical, right?

Christine Brunner

Definitely. I mean, not just in the US. Workforce, skilled workers.

Lindsay Gorrill

Yeah, and one of the reasons why we picked Buckeye, Arizona, was because it’s the largest, it’s the fastest-growing city in America. And what we’ve been working on specifically is working with the university, the community college, the tech schools and even the high schools to lay out programs that we need for our facility, right? For example, we’re donating a lot of batteries into one of the tech schools to develop a lithium ion service center, because not only are you going to build it, someone’s installing them, someone’s got to service them. So it’s a whole other level, right? And I think people think a lot about, you know, they’re worried about hiring. We’re worried about retention, right? So you’ve got to make a company that people want to work for, right? That’s important.

Christine Brunner

Definitely. We are.

Lindsay Gorrill

Yeah.

Christine Brunner

We are, and that’s so good to see them become here at Hanover Messe, for example. At Siemens, we use the hashtag #ProudToBeSiemens. And when you come to this booth, when you enter that booth, that definitely kind of comes into your full body and you appear as the person proud to be Siemens. So I guess that’s the same for you in the US then. Are you doing some special activities in order to motivate?

Lindsay Gorrill

We do a lot of activities. I think everybody’s part of the team, right? We’re one big team kind of thing. And we do a lot, because I’m an entrepreneur, we have structure, but everybody works together. So it works well. Yeah.

Christine Brunner

That’s great to hear. Mathias, in regards of wrapping up and bringing in some more topics from the smart infrastructure side and the grid, of course. I mean, without the grid, e-mobility is nothing. What’s in your pocket in regards of really to play that game?

Matthias Rebellius

First, we say smart infrastructure is sustainable infrastructure, because all these elements that we are talking about here, be it from the electric mobility, but also especially from the medium voltage and low voltage, electrification, portfolio, building, don’t forget, you have to reduce the demand every kilowatt hour not being used. It’s the best one not to be produced. And all of this makes infrastructure so important. We put digitalization on top as part of our accelerator portfolio to take complexity out, to take better decisions. And what is the motto here also at Hanover is industrial transformation starts here. It starts together with KORE Power and Siemens. And in this booth, you learn how you can even accelerate the transformation. So that’s what we are here for.

Christine Brunner

Very well said. And Veronika, I phrased in the beginning, Siemens financial services is more than money. Anything else to add here?

Veronika Bienert

Yeah, so for me, it is really drive the partnering on a local level and really enhance the network on a local level, but then really grow the network on a global level, because at the end, the entire economy is connected and we need to support each other. And in order to drive the sustainability journey on a global level and really to contribute accordingly. And you were mentioning several times really the entrepreneurship. For me, it is really this partnering topic first hand, then really combine innovation, technology and financing, then really bring it really to the next level and ensure from an entrepreneur perspective your competitiveness. So really that if our customers stay competitive, we as Siemens as well stay competitive. And the innovation journey is so fast, so we always need to stay ahead of the curve. And our desire is really, and our responsibility is to keep our customers really as well ahead of the curve.

Lindsay Gorrill

Yeah, the support has been unbelievable. Seriously, it’s unbelievable.

Christine Brunner

This is what we love to hear, but as I said, we are very passionate, not just for our own products, also for bringing the benefits to our customers. And with that, I would like to close this session and say a big thanks to the three of you, really great insights and motivating perspectives for the future, how that business will evolve. Thank you very much. Have further a great time here at the fair, and the applause is yours. All the best. Thank you, Veronika and Matthias.

Lindsay Gorrill

Thank you. Enjoy.

Veronika Bienert

Thank you, Lindsay.

Nick Finberg

Thanks to the audience as well! There are so many great conversations that can be easy to miss if you don’t make it to the many events we participate in around the world throughout the year. For more coverage surrounding battery, make sure to subscribe. And there are some great conversations in the works with our residents hosts Puneet Sinha and Marc Deyda to anticipate. But until then, make sure to check out our other episodes covering different areas of the battery industry or our website siemens.com/battery.