How automotive trends are changing the ways we move from point A to B

The automotive industry has been one of the most dynamic and exciting incubators of technological and product innovation in the modern world. A unique mix of investment, consumer interest, and industry competition has driven this dynamism with a constant search for the next feature, style, or capability to capture the public imagination. At the 1964 New York World’s Fair, General Motors (GM) hoped to capture such interest with the Firebird IV concept car. GM explained, then, that the Firebird IV “anticipates the day when the family will drive to the super-highway, turn over the car’s controls to an automatic, programmed guidance system and travel in comfort and absolute safety at more than twice the speed possible on today’s expressways.” (Gao, Hensley, & Zielke, 2014).

GM’s vision of the future was striking and exciting, but the technology did not yet exist to make it a reality. Ford took a different approach to generating buzz in the market, focusing on the present. Instead of forecasting a future of self-driving cars and super highways, Ford launched a car for “young America out to have a good time”: the Mustang (Gao et al., 2014). It engaged the new generation by providing both transportation and personal expression in a stylish, highly configurable, and inexpensive package. Ford estimated it would sell 100,000 Mustangs, but one year after the launch it had sold over 400,000 (Gao et al., 2014).

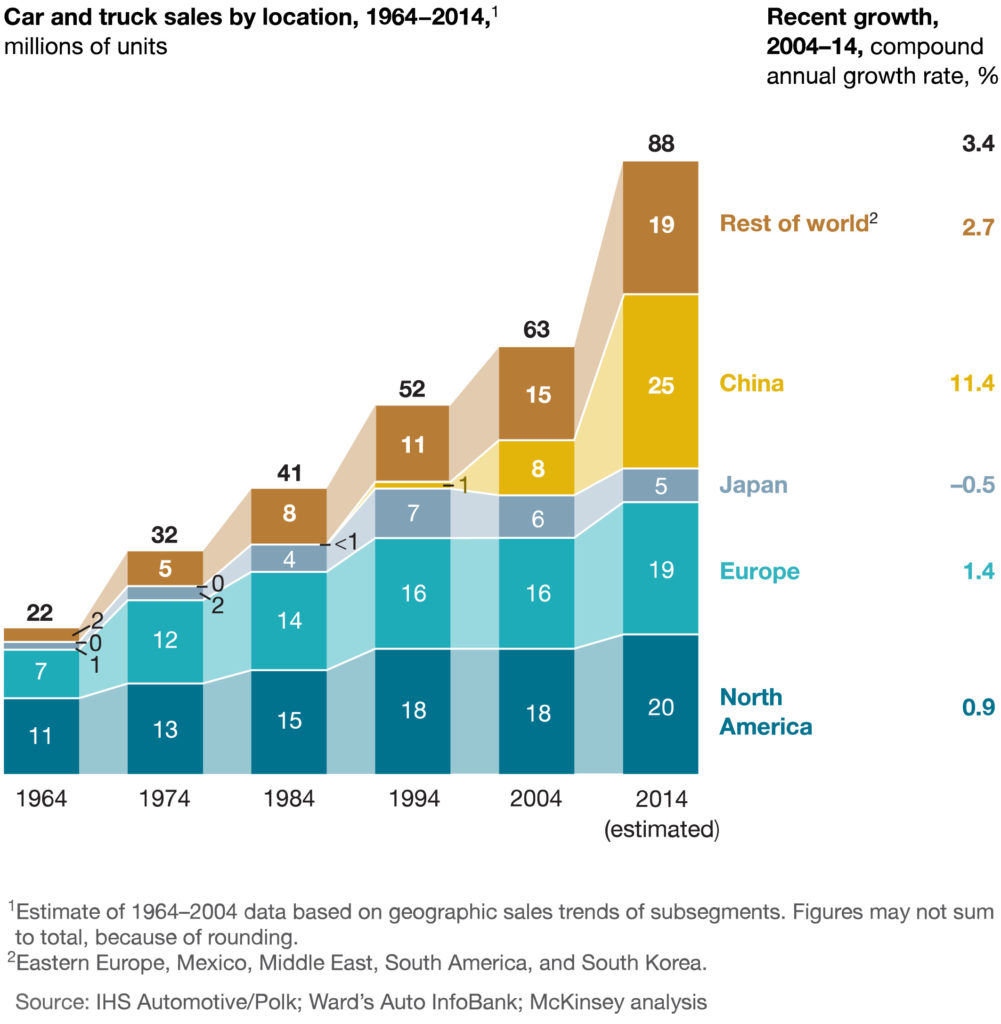

Vehicles are now a central feature of everyday life. Since 1964, global vehicle sales have grown by nearly 3 percent on average each year, nearly double the rate of population growth, resulting in one billion vehicles on the road today (figure 1; Gao et al., 2014).

However, large-scale trends, such as a surging Chinese automotive market, electrification, and urbanization, are beginning to affect the form and function of vehicles and personal mobility systems.

China leads the way

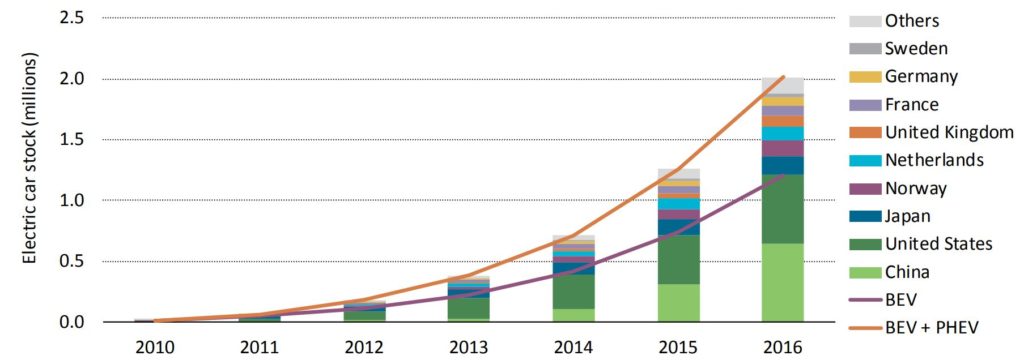

In the decades ahead, China’s emergence as a dominant market and production center will have major implications on the future of automotive and transportation systems. China has supported the largest electric car market by far, accounting for more than 40% of electric cars sold in the world and more than double the amount sold in the United States (figure 2; International Energy Agency, 2017).

China will lead the transition from internal combustion engines to electric cars, with EV sales accounting for almost 50% of the global market from now to 2025 and 39% in 2030 (International Energy Agency, 2017). The International Energy Agency’s Global EV Outlook (2017) also cites China as the global leader in electrifying other modes of transport including busses, two-wheelers, and low-speed vehicles.

Such enthusiastic adoption of EVs and multi-modal, all electric mobility options has hit automakers that have yet to develop meaningful electric offerings. In China, GM experienced a 17.5% drop in third quarter sales compared to the same period in 2018 (Essex, 2019). In fact, the market share of all U.S. automotive brands fell to 9.5% in the first eight months of 2019, down from 10.7% a year earlier (Essex, 2019).

Another global trend, of which China is also an epicenter, promises to continue this evolution in the automotive and transportation industry: urbanization. According to the United Nations’ 2018 World Urbanization Prospects report, 70% of people lived in rural settlements worldwide in 1950. By 2050, the report projects a nearly inverse distribution, with 68% of the world population living in urban areas.

Personal mobility will continue to be a critical piece of everyday life. Therefore, governments are undertaking large-scale studies to examine population mobility in an attempt to prepare for greater urban population density. Vehicle connectivity, electric and self-driving cars, as well as mobility systems will be essential to supporting population mobility in these dense urban centers.

Personal mobility is about to shift dramatically. Data will become the key driver of mobility services and solutions, causing automotive original equipment manufacturers (OEMs) to change their business models completely. Connectivity, assisted driving, and e-mobility are just three trends that are shaking up the world of traditional automotive OEMs. Moving forward, OEM’s will derive more revenue from the data generated from a car than the sale of the car itself.

Growing digitalization will generate new business models

As urbanization progresses, real-time connectivity will be pervasive between vehicles and smart vehicle infrastructure, enabling a greater number of vehicles to travel safely and efficiently (figure 3). Growing automotive digitalization also allows software updates and remote performance, emissions, and maintenance data monitoring to ensure safety and reliability.

The shift from mechanical to digital systems will benefit OEM’s with new business models. Sensors on cars will record everything happening, both in the car and in the external environment. OEMs will be able to leverage this data to create new opportunities for revenue generation. Recording a car’s route, its speed, the wear and tear on its components, and even road conditions can be used to enhance customer service or provide predictive maintenance suggestions. Sensors collect telematics and driver behavior data. That data can be analyzed in real-time to keep the vehicle’s performance, efficiency, and safety in check. It also provides vital feedback for cities and states about traffic volume and roadway design.

Researchers at McKinsey and Company estimate that the market for vehicle-gathered data will be worth $750 billion a year by 2030 (Bertoncello, Camplone, Husain, & Möller, 2018). The merging of the physical and digital worlds through digitalization will open up new revenue opportunities to those companies that experiment and adopt change faster. It is critical for automotive OEMs around the world to invest in digitalization technology to capitalize on the immense opportunity available in the future of mobility. The automotive industry has learned quickly that consumers demand digitally enhanced experiences as they are researching, purchasing, and operating their vehicles. In addition to these new customer demands, the industry is under constant influx of new technologies and new players. The automotive industry is changing, and doing so quickly.

Industry giants are moving away from the traditional role of hardware provider and embracing the role of connected mobility and transportation solutions providers, ranging from new digitally enabled services to the software-driven, battery-operated, artificially intelligent, autonomous vehicles of the future. As they undergo this transition, digitalization in the automotive industry will synergize with other industries, leading to more revenue opportunity. For instance, the merging of the physical and digital worlds through the Internet of Things (IoT) could generate up to $11.1 trillion a year in economic value by 2025 (Manyika et al., 2015).

The concept of the autonomous freedom machine will transform over the coming years. The change has already begun as electronics and software overtake critical systems in the automobiles of today. In particular, automotive embedded software is one of the most important systems in modern vehicles. Embedded software controls everything from infotainment and passenger comfort to vehicle essentials, like engine control, braking and steering, to more advanced driver assistance, safety and security features. The realization of higher levels of autonomy will only cement the importance of software, as it will form the decision engine for self-driving systems.

This is part one of a seven-part series on the growing importance of automotive software. New parts will appear below, or visit siemens.com/aes to learn more.

Part 2: The Data Deluge: What do we do with the data generated by AVs?

Part 3: From Mechanical Marvels to Software Suites: The growing role of automotive embedded software

Part 4: Automotive Embedded Software Takes Center Stage

Part 5: Application Definition and Planning

Part 6: Application Development and Quality Assurance

About the Author

Piyush Karkare is the Director of Global Automotive Industry Solutions at Siemens Digital Industries Software. Over a 25 year career, Piyush has a proven history of improving product development & engineering processes in the electrical and in-vehicle software domains. His specialties include integrating processes, methods, and tools as well as mentoring product development teams, determining product strategy, and facilitating innovation.

References

Bertoncello, M., Camplone, G., Husain, A. & Möller, T. (2018, March). Accelerating the car data monetization journey. McKinsey Center for Future Mobility. Retrieved from https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/accelerating-the-car-data-monetization-journey

Essex, R. (2019, October 10). GM’s China sales continue to slump in third quarter as US automakers lose market share. Detroit Free Press. Retrieved from https://www.freep.com/story/money/cars/general-motors/2019/10/10/gm-china-sales-stock-baojun-buick/3929650002/

Gao, P., Hensley, R. & Zielke, A. (2014, October). A road map to the future for the auto industry. McKinsey Quarterly. Retrieved from https://www.mckinsey.com/industries/automotive-and-assembly/our-insights/a-road-map-to-the-future-for-the-auto-industry

International Energy Agency (2017). Global EV outlook 2017: Two million and counting. IEA Publications. Retrieved from https://www.iea.org/publications/freepublications/publication/GlobalEVOutlook2017.pdf

Manyika, J., Chui, M., Bisson, P., Woetzel, J., Dobbs, R., Bughin, J. & Aharon, D. (2015, June). Unlocking the potential of the Internet of Things. McKinsey Global Institute. Retrieved from https://www.mckinsey.com/business-functions/mckinsey-digital/our-insights/the-internet-of-things-the-value-of-digitizing-the-physical-world

United Nations Department of Economic and Social Affairs. (2018). World Urbanization Prospects 2018 Highlights. Retrieved from https://population.un.org/wup/