The power of insight: Rethinking supply chain decision making – part 1

Supply chain management is at a crossroads. Traditional, reactive approaches are no longer sufficient to navigate the complexities of today’s global marketplace. To thrive, organizations must embrace a proactive, data-driven strategy.

This is part one of a two-part series, we delve into the challenges hindering effective supply chain management and explore how a culture of data-driven supply chain decision making can unlock new opportunities. We will examine real-world case studies to illustrate the transformative power of advanced analytics and strategic planning.

Join us as we embark on a journey to rethink supply chain decision-making and discover how to harness the power of insight to drive business success.

Key challenges in supply chain management at a glance

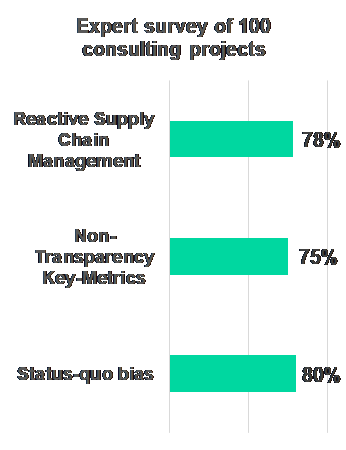

In our daily work, we observe three key challenges that consistently impact supply chain management:

- Reactive supply chain management. Most current supply chain management approaches are reactive, characterized by structural rigidity that increases operational costs, lowers service levels, and misses potential revenue opportunities. This reactive mode keeps organizations in continuous short-term firefighting, preventing strategic, long-term planning.

- Lack of transparency in key metrics. A notable lack of visibility into costs, performance metrics, and their drivers often leads to decision-making based on incomplete information, resulting in suboptimal outcomes driven by gut-feeling rather than informed judgment.

- Status-quo bias. A significant bias exists towards maintaining the current state within supply chain management, largely due to the labor-intensive nature of evaluating complex decisions or business cases. This inaction perpetuates itself, going unnoticed amid constant changes in growth patterns, business model adaptations, or disruptions. As a result, opportunities for learning and innovation are missed, stifling improvement.

Create a culture of data-driven supply chain decision making

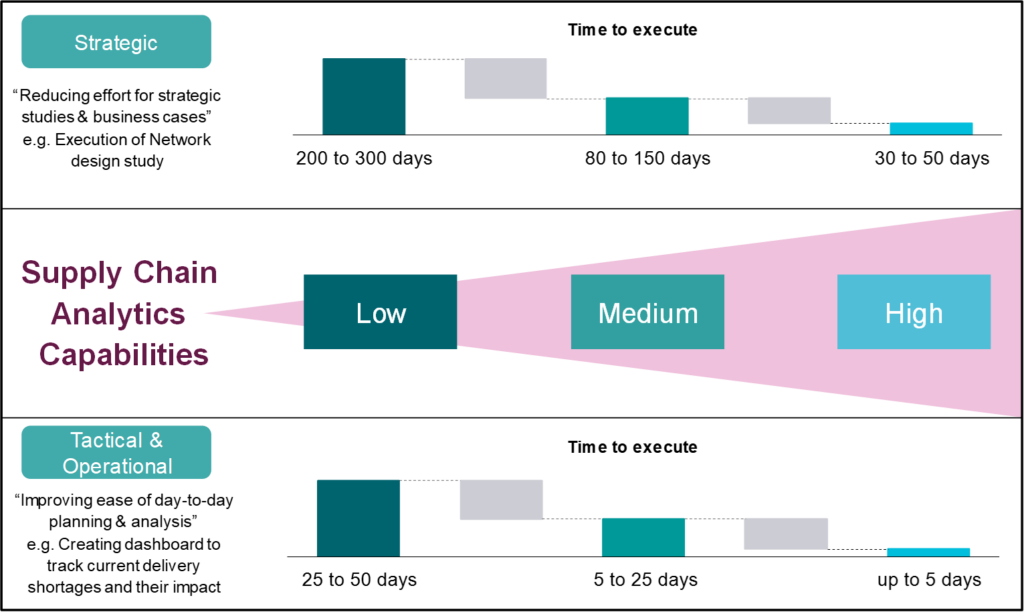

Building the right capabilities. Finding a path out of this stagnation involves cultivating a culture of data-driven decision-making, supported by high-level management. Fostering teams that regularly engage in “what if?” scenarios, supported by a transparent understanding of current conditions. Determining last month’s supply chain performance should be as easy as querying GPT4 for the height of the Eiffel Tower. Achieving this capability will not only optimize one-time decision-making but also promote continuous improvement by reducing the marginal costs of addressing strategic questions and enhancing the efficiency of tactical and operational inquiries through easy access to insights.

Reduce high marginal decision costs. Time and resources required to address strategic, tactical, or operational questions are critical success factors. If a strategic evaluation of the supply chain network demands excessive resources (e.g., over 200 project days), it is unlikely to be conducted. Similarly, if operational inquiries require substantial effort (e.g., more than five project days), they are often bypassed with simplistic explanations. In both cases, the cost of a data-driven approach is too high to engage.

Boost supply chain analytics. A higher capability level can make such studies straightforward. Excessive effort can stem from organizational hurdles, data accessibility issues, disparate systems, lack of expertise, or inadequate analytics tools. Lowering these barriers reduces costs and enables a more data-driven organization

Case study 1: Achieving transparency and strategic fit

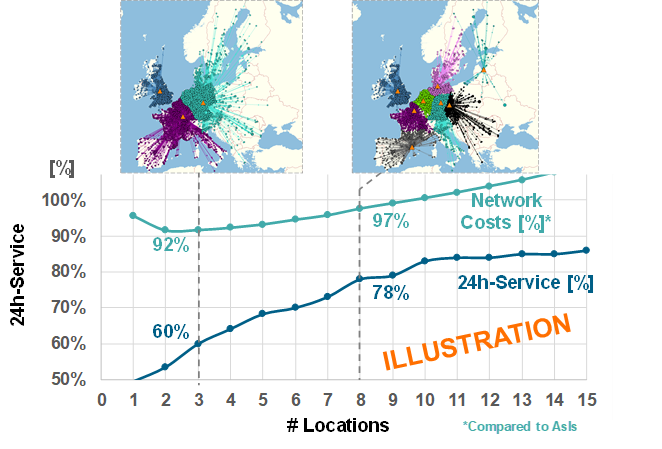

Context: The spare parts division of a leading international mechanical manufacturer faced rising demands for enhanced service levels. The division’s performance metrics revealed a global “next day” service level of approximately 50-60%, with significantly stronger performance in Europe compared to their emerging markets in the Americas and Asia.

Challenge: The supply chain was originally optimized for European operations, resulting in capacity and service level disparities in other regions. Distribution centers, especially those in growth markets, were operating beyond their productive capacity limits. Additionally, the company was incurring increased costs as expedited air freight became a regular practice to compensate for service level deficiencies, even for standard components. The leadership faced a supply chain with opaque operational visibility, possessing only broad cost and service data without insights into the causal factors or drivers—highlighting a disconnect between high-level management KPIs and the operational metrics needed to steer the supply chain effectively.

Strategic Analysis: Recognizing the need for a systematic approach to review the network structure and align corporate and supply chain KPIs, the team embarked on a strategic study to quantitatively and qualitatively assess their current and potential future distribution network. This effort started by creating a transparent baseline that integrated disparate data sources into a unified planning database. Using advanced analytical methodologies, the team dissected relevant cost and performance drivers, establishing a clear foundation for the study. Qualitative insights from customer feedback and supply chain stakeholders supplemented this data, providing a comprehensive framework that accounted for current processes, costs, and growth projections.

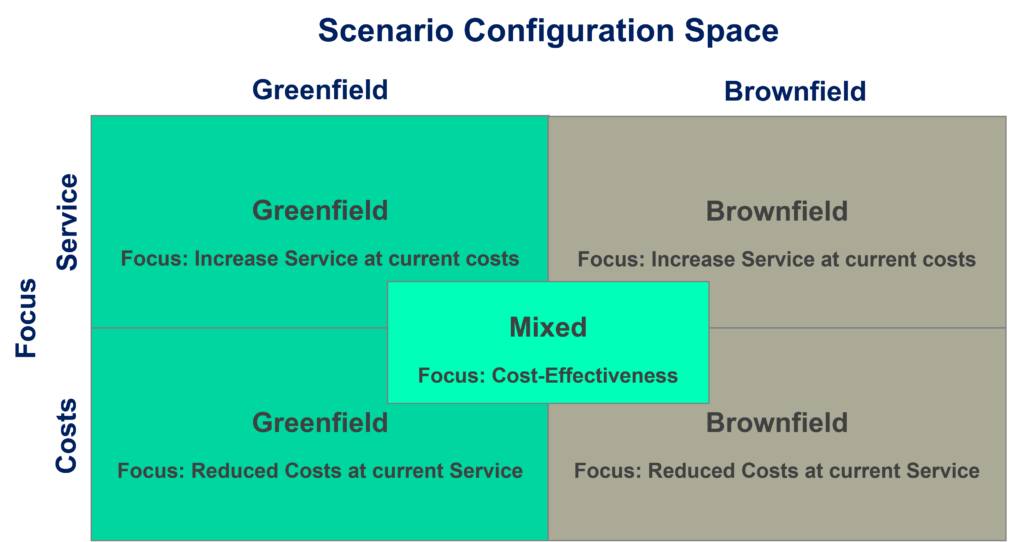

Scenario Planning: Building on this analytical foundation, the leadership team explored various scenarios to optimize the DC network footprint, inventory policies and transportation, considering regional growth trends, geographic customer distribution, and demand patterns. A digital twin was setup to evaluate following scenarios:

- Greenfield options: Where existing DC infrastructure could be completely reconfigured.

- Brownfield options: Where modifications were limited to extensions of existing locations.

- Mixed approaches: Combining elements of both greenfield and brownfield scenarios.

Strategic Outcomes

The strategic exploration helped the leadership team make informed decisions about optimizing the supply chain network to better align with global service demands and cost efficiencies. This proactive approach facilitated a deeper alignment of strategic goals with operational capabilities, enhancing the organization’s responsiveness and efficiency in key growth markets.

Implementation

The selected scenario for implementation was a “mixed” scenario focusing on cost-effectiveness providing the best strategic fit to the overall business strategy, with following key points:

- Network Optimization: The implementation plan retained most existing DC locations and capacities while expanding with additional DCs in the highest growth regions to enhance service levels and accelerate market penetration. Using service providers to minimize investment requirements.

- Inventory Management: A stock return initiative for “slow-moving” items was introduced, coupled with a restructuring of regional inventory policies. This strategy aims to free up capacity at DCs for higher-turnover SKUs, improving overall inventory efficiency.

- Order Optimization: A pilot program was launched for dealers and independent service providers to optimize ordering behaviors through local inventory recommendations, tailored to local and regional demand patterns.

- Local Distribution Center Setup: A dedicated local DC was established to supply a re-manufacturing plant directly. This setup reduced double handling by circumventing the central DC, which liberates vital capacity and cuts operational costs.

- Governance and KPI Redesign: A global governance and KPI methodology overhaul was initiated to equip regional units with the appropriate processes, methods, and tools to effectively manage local supply chains.

- Enhanced Analytics Capabilities: The project enhanced analytics and modeling capabilities, with significant client involvement in building the digital twin of the supply chain network. Following initial training, the client independently utilized the digital twin, fostering ownership and sustained capability building.

- Supply Chain Analytics Solution: A tailor-made analytics solution is being established to significantly improve data accessibility and supply chain transparency. Empowering users to become makers which support faster strategic decision-making as well as continuous tactical optimization.

Expected Outcomes

The strategic roadmap outlined in this blueprint is projected to reduce annual supply chain costs by 5-9%, while requiring minimal investment. Additionally, these measures are expected to enhance the average “next day” service level by 6-10%, demonstrating a significant improvement in operational efficiency and customer satisfaction. These enhancements can in turn improve market competitiveness and foster greater customer loyalty, as faster and more reliable service levels meet and exceed customer expectations, driving repeat business and attracting new clients.

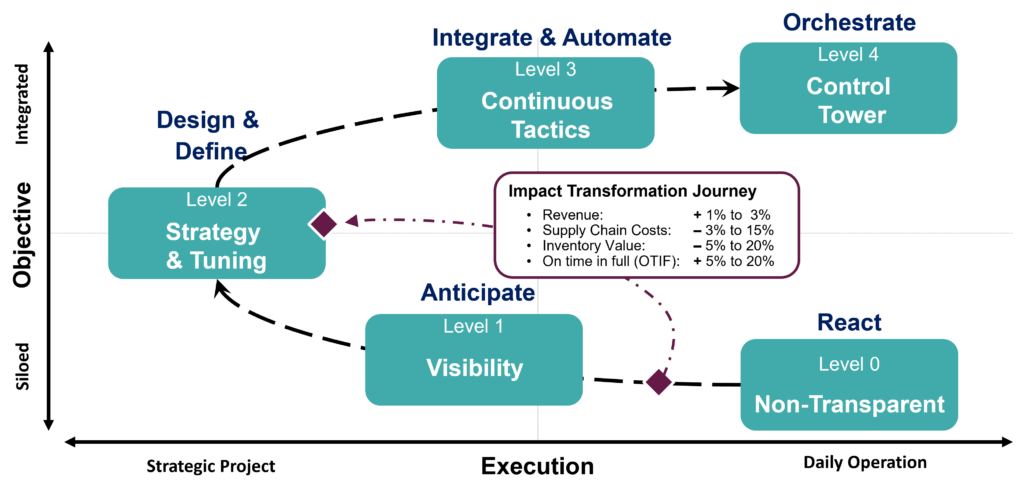

Strategic Advisory on supply chain optimization: Having guided numerous clients through the process of achieving a high strategic fit of their supply chain network while driving continuous improvement, we recommend embarking on this endeavor as a structured, multi-step journey (refer to next graphic). This process begins with the integration of all relevant data sources—including e.g. ERP (Enterprise Resource Planning), WMS (Warehouse Management Systems), MES (Manufacturing Execution Systems), questionnaires, and company or business unit strategic targets—into a unified “database”.

This consolidated “single-point-of-truth” serves as the foundation for enhancing transparency. It enables a comprehensive analysis of relevant cost and performance drivers, setting robust groundwork for all subsequent activities. By establishing this detailed analytical base, organizations can ensure informed decision-making and strategic alignment across their supply chain operations. Moreover, this approach significantly reduces marginal decision / study costs by improving data availability and enhancing supply chain analytics capabilities. This shift encourages addressing more operational and strategic questions in a data-driven manner, serving as an ideal spearhead initiative to drive cultural change within the organization.

Conclusion

As we conclude the first part of our discussion on transforming supply chain management, we have laid the groundwork for understanding the key challenges and strategic responses necessary to cultivate a dynamic, data-driven supply chain environment. In the upcoming second part of our paper, we will extend our exploration into a focused case study on intralogistics challenges, demonstrating practical applications of these strategies. Additionally, we will introduce a self-assessment framework to help organizations evaluate their current capabilities and readiness for implementing these transformative practices. Stay tuned as we continue to uncover how advanced analytics and strategic planning can significantly enhance operational efficiencies and drive competitive advantage in the marketplace.

The Expert

Partner Consulting | Siemens Digital Logistics

Want to learn more?

Contact Siemens Digital Logistics today to discuss how our solutions can help your business thrive in the face of these new regulations. Learn more about our Consulting services.

More information

Contact us (select “Digital Logistics” as Product)