The Future Car – Vehicle Electrification – The Importance of Electrical and Electronic Systems – Transcript

A major theme of our discussions here on the Future Car podcast has been the large-scale disruption taking shape in the automotive and transportation industry, evidenced by the rapid growth of electrified, semi-autonomous, and connected vehicles. We have talked a lot about how these trends are changing the nature of automotive development processes and business models, with collaboration and integration becoming ever more critical to successful vehicle development.

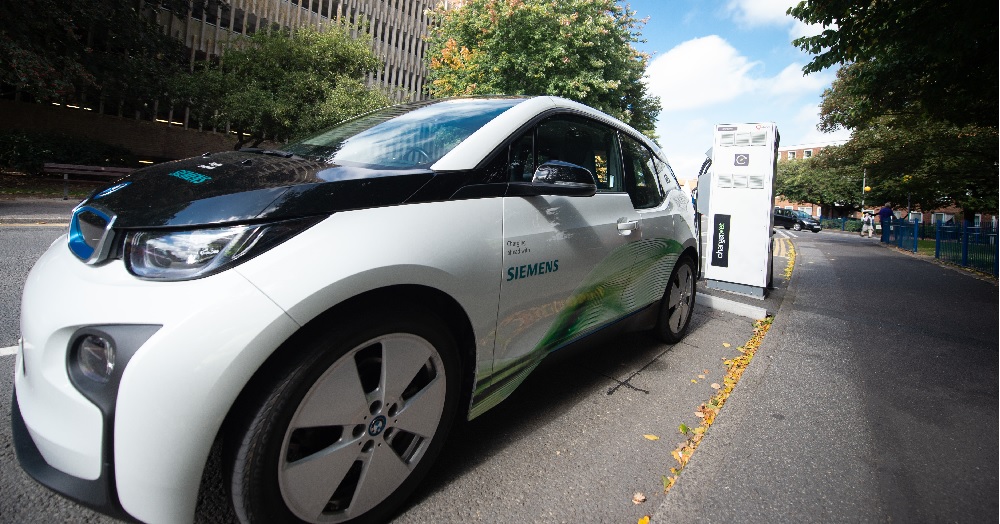

Vehicle electrification is driving a lot of change in the near term as nearly every automotive manufacturer has or will soon have EVs available to the public. With that in mind, I sat down with Doug Burcicki, Senior Director of Automotive and Transportation and Heavy Equipment within Siemens Digital Industries Software’s Integrated Electrical Systems (IES) group, and Migo Richter, Market Development Director and also from IES. In this new episode of the Future Car podcast, Doug, Migo, and I discuss the past and present of automotive E/E systems, how complexity alters vehicle development, and how digitalization can empower companies to pursue vehicle electrification and other next-generation vehicle technologies. You can listen to the episode here, or read the transcript below!

[00:10] Conor Peick: A major theme of our discussions here on the Future Car podcast has been the large-scale disruption taking shape in the automotive and transportation industry, which has been evidenced by the rapid growth of electrified, semi-autonomous, and connected vehicles. We have talked a lot about how these trends are changing the nature of both automotive development processes and business models, with collaboration and integration becoming ever more critical to successful vehicle development. Vehicle electrification is driving a lot of change in the near term as nearly every automotive manufacturer has or will soon have EVs available to the public. Though vehicle electrification may not seem as revolutionary as autonomous vehicle technology. The switch to electric power trains is already having wide-ranging impacts on various vehicle systems from the chassis and the handling to the packaging of various electronic components and much more. This is not to mention the large-scale infrastructure changes that will be required to support these new vehicles. So, today, we are going to talk in detail about the electrical and electronic or EE systems within vehicles. These are comprised of the electrical wiring, electronic devices, networks, and software within the vehicle. And they stand to grow in complexity and importance as automotive, electrical, and electronic content grows. So, to cover this topic. I’m going to be joined today by Doug Burcicki and Migo Richter. So, welcome to you both and glad you guys are here to talk with me today.

[01:30] Doug Burcicki: Thank you, Conor. A pleasure to be here as always. As you said, my name is Doug Burcicki. I’m responsible for market development within what we refer to as IES or Integrated Electrical Systems, which is part of the Siemens Digital Industries Software organization. In the markets, I’m focused on predominantly our automotive and heavy equipment. And I think this topic is very pertinent for obvious reasons based on the changes taking place in the industry, and has been taking place in the industry for several years, and continues to accelerate. And I’m looking forward to our discussion today.

[02:06] Migo Richter: Hi, thank you for inviting us. My name is Migo Richter. I’m part of the Siemens IES Automotive and Transportation Market Development Team, working with Doug, located in Germany in Munich. And I joined Siemens in 2019. And before that, I worked for more than 25 years in the automotive industries in several more technical aspects. I’m happy to be here today.

[02:25] Conor Peick: Excellent. Well, thank you guys. My first question was going to be for some brief introductions and we got that out of the way already. So, I think we can start off our discussion today by taking a look back at sort of the recent history of the automotive industry, and obviously, EE systems in particular. So, we’ve already seen some significant changes just in the last 10 years. I’m curious, have those been kind of setting the stage for what’s going on right now.

[02:51] Doug Burcicki: As you said, there’s been a lot of changes that have been taking place over the last 10 years. And maybe it’s been more visible and apparent to everybody because of the number of new entrants, the new vehicles that have been entering the marketplace. Some of these vehicles, it’s hard to go a day without seeing articles or headlines about them in the press. Companies like Tesla really have become very forefront and are hand-in-hand associated with electrification. But some of the architectural changes that underlie these transformations have been in play for several years, if not decades. And the concept of an electric vehicle is definitely not a new one. You can go back and see that in the early 1900s, just in the Americas alone, there were well over 100 car companies that were focused on making electric vehicles at the time, each of them with unique designs and approaches to the market. But while the technology varied greatly at that time compared to today’s sophisticated electric vehicles, the challenges that those companies ran into are very much the same. They had to design attractive products that were desired by consumers. They had to do it at a scale that allowed them to maintain profitability. And we’re required to return profits back to investors or shareholders. And at a minimum, if they were privately held entities, to keep their operations running and to be able to invest in those operations so they could maintain that level of competitiveness. Given the fact that we’re talking about EVs in the last 10 years is a relatively new phenomenon. And I think history shows that most of those companies did not succeed. Those challenges that they struggled with at the time are no different now. There are different scales and different levels of investment and different technologies of play. But the underlying e-architecture has evolved gradually over time, and it’s gotten to a point to where now you can see vehicles that are able to be produced at scale in a profitable fashion. And more importantly, they’re cars that people want to buy, people want to own.

[05:05] Doug Burcicki: Some of the original EVs of recent memory if you look back 25 years ago or so, most people refer to the Prius as the modern day advent of an electric vehicle, was a technology breakthrough in many regards, many would argue as to its level of attractiveness. And then there were a lot of cars that followed suit, that checked the box as far as being EVs. And they definitely contributed to improvements in environmental performance and emissions. And for many companies, they’re referred to as cafe requirements but their levels of emission need to be adhered to, otherwise, penalties are paid. So, there was a financial motivation to producing those cars. But a lot of those cars were built on existing internal combustion engine architectures or platforms. As a result, they were limited in design flexibility, styling flexibility, and were not as attractive as some of the vehicles we’re seeing today. Now, we’re starting to see a whole generation. I mean, literally, over the past year, 18 months, there have been dozens of brand new vehicles that have been engineered from the ground up from day one with the sole intention of being electric vehicles. And they’re stunning, they’re beautiful cars that are fun to drive. They have a different level of performance and sophistication to them. And you’re seeing the traditional OEMs, who were, obviously, focused on the traditional power trains and technologies because that’s what their infrastructure was geared towards and what their capital investments were around can ignore the attractiveness of these vehicles and the fact that they’re losing market share in certain cases to these new startups. So, you’re seeing them very aggressively enter into the space as well. So, it’s a very active and exciting time to be part of it.

[06:59] Conor Peick: Yeah, definitely. Migo, anything to add there?

[07:03] Migo Richter: I totally agree to Doug’s points, of course. There’s a long history in this EVs. And now today, we see these new market entrants. But I think in the last 10 years, we already had kind of a change in this industry-driven, for example, by the autonomous vehicles where new architectures were introduced, multi-voltage electrical systems were introduced to cope with the rising power consumption needs; therefore, active suspension, and all these sensors, and all that stuff. We had weighed optimization activities going on for the last years to optimize fuel consumption. And I think all this now comes into one point and really contributes to these EE systems that are necessary for the EVs. So, I think that was a quite good preparation for that from a technical perspective as well.

[07:53] Conor Peick: I think that’s a perfect transition into the next point I wanted to bring up, which is, there’s been a lot of discussion about how the current technological trends, at a high level, are really changing the automotive industry. Now, I was curious how you guys see these affecting the EE systems in particular.

[08:11] Migo Richter: Some of the current trends that we see, for example, this customer demand for more infotainment, this explosion of sensors that we see there. That changed expectations from the customers with regards to the brand so that they don’t really identify with the brand but with the functionality and the user experience that we see in the car and the options to update the car, and all that stuff really all contribute to this to this change. So, I think these are some of the current trends that are really influencing that.

[08:45] Doug Burcicki: Migo brings up a real interesting point there about the brand recognition, and quite honestly, the brand loyalty. The attributes that drive the purchase these days is changing. It used to be kind of people who were environmentally conscious were focused on EVs or hybrids because they saw more holistic benefit to that purchase, one that wasn’t simply justified by the price of the vehicle over its lifetime, which the majority of consumers are more motivated by that; they want to see a good value for the amount of money they’re spending. I mean, a car is next to your home, one of the most significant investments that an individual makes in their lifetime. So, they want to see that money well-spent, but again, they have an emotional attachment, or at least historically have. And the younger consumers. When I say younger, I’m talking about kids like I have. I have four children that are all young adults and driving and have been for years. And every one of them was more concerned about whether the car was connected or had certain features and functions as opposed to the brand of vehicle it was or maybe even the style or the color, which when I looking at a car was was a primary motivator for me when I was growing up. So, the buyer behavior is changing. And the things they desire are greener, more sustainable or circular vehicles today. They like to know that they’re contributing to a healthier planet long-term. But again, they want their features and functionality too, and they all expect to be able to carry their phone into the car, for lack of a better term, and have it connected just like their phone is when they’re outside of the vehicle. It’s an extension of their lifestyle. And the phone is definitely a part of every young adult’s lifestyle these days.

[10:39] Doug Burcicki: So, it is a different buyer dynamic. And you see personalization is a big aspect of these vehicles too. The architecture that enables all of that stuff has to be entirely revamped and redefined from what it was historically. 25 years ago, 30 years ago, when I started my career, I was a systems engineer and common methodology was “We’re going to add a feature or add a function. We’re going to add a module and the connecting circuitry and switches to make it happen.” And that was the case for many years. Now, we started to see migration into zonal controllers where you’re trying to integrate more features and functions into fewer ECUs. And that has an impact on the physical structure. Well, now we get into business model changes that are affecting the architectures, every OEM out there now is trying to figure out a way to monetize a car after it’s sold. And the way to do that is via software, software updates, software features and functionality that leverage componentry that’s already in the vehicle for years to come after a vehicle has been sold. To do that, you have to have over-the-air update capability. And none of that existed on architectures, you know, as recently as five years ago for many OEMs. So, there’s a lot of different factors converging together that are driving new architectures. The EV aspect of it is definitely one because these are higher power consumption vehicles from an electronics perspective, higher compute power. As a result, they’re more efficiently run on these types of architectures. Again, that’s the best way to achieve the holistic environmental impact as well, which is becoming a much greater priority to the younger generations of our planet today.

[12:35] Migo Richter: And this is a global trend. It’s even here in Germany, where I would say people are quite conservative. This expectation has really changed from a quite static product that we had in the past – you just buy the car and then you use it – to expectation like you have on your phone where you expect that you get updates, maybe not every day, but quite frequently, and the product is kept up-to-date via updates, and new software, new functions, or things you can buy on demand if you really needed. And this all is then, of course, reflected in the underlying technology. So, you need high-speed networks, you need high-speed connection to the internet, you will have new threats like cybersecurity topics and functional safety aspects. So, this really changes everything.

[13:27] Conor Peick: Absolutely. Security is one of those big topics that I think is going to really change going forward with the advancement of kind of vehicle technology. So, I’m curious, looking forward, what do you guys think these architectures are going to look like in the next five to seven years, perhaps?

[13:47] Doug Burcicki: Well, I think you’re going to continue to see a consolidation of chipsets, you’re going to see higher compute power chipsets. In certain cases, you’ll see reprogrammable, or modular, or even VCUs that are referred to as Virtual Control Units. And what that means is you can move and allocate features and functions to different chips within the architecture as opposed to the prior method that I referenced where if you add a chip or a module for each feature. And that was because those features or boxes were designed to support that function and that function only. Nowadays, and even just in the past couple of weeks, there’s been major announcements from multiple OEMs about entering strategic partnerships with chip suppliers. The OEMs are specking out IO and compute power functionality from these chips. But they have yet to determine what software is going to be running on them. And they may have architectures where if they have three modules or zonal modules that are the backbone of their architecture, what features and functions are in Box A may be different than what’s in Box A on a vehicle variant or a vehicle that’s coming off that same global platform depending on what region that vehicle is being produced and sold in. And that allows them to address regional requirements and homologation of the regional requirements. It also allows for reuse of software without having to revalidate all the hardware associated with it. So, you’re seeing a much greater degree of flexibility in these architectures. And it’s a move away from, I guess, the historical methodology, your thought process, which is, you want to put the base amount of componentry or hardware in a vehicle at all times in order to keep costs down. Now that you can tie a software revenue stream to hardware that may not be utilized until it’s after the point of the vehicle has been sold, there’s a different business value proposition for the OEMs that justifies and enables investment in technologies that may not be used till later in time if at all. So, it is a much different approach.

[16:09] Doug Burcicki: And as you said, Conor, one of the biggest concerns or factors of consideration is cybersecurity of these vehicles. When you open up that window that allows over-the-air updates, you’re opening up a window to a potential for hack and intrusion, and you’re opening up the surface areas of attack in your vehicle. So, that is something that’s, I wouldn’t say a new concern. OEMs have always been very risk-averse and concerned about that type of situation, even in traditional canvases architectures. But it’s much more prevalent now and it’s something that they’re addressing much like a consumer electronics company would who’s supplying handsets or mobile phones, or Wi-Fi interfaces to your home compute system. And those are areas of investment that they haven’t historically had to make. So, there are different considerations as these architectures become more sophisticated over time. It’s a challenge, but it’s an area that you can see these OEMs are aggressively investing into and trying to transform organizations to keep pace with the changes that are needed.

[17:19] Migo Richter: And on top of these security topics, I think we really see functional safety and redundancy requirements. So, in five years, probably, we won’t see the fully autonomous cars driving around that were promised a few years ago. But the expectation goes towards these assisted driver assistance systems, towards more comfortable driving with all these support from Lane Keeping and even simpler assistance that you see there, which will really make it necessary to adopt some technologies or techniques from the aerospace industry, for example, for redundant systems to ensure these functional safety requirements. And this even goes a step further so that we will probably see more zonal architectures instead of these monolithic ones that we have today. We could see a more standardized system if we think about fleets of cars instead of individual ones if you look at all these car-sharing stuff. As a result of that, we’ll probably move towards a more or a highly automated production of these components to really ensure the quality, to ensure the consistency of the outcome of the quality of the product. So, this is moving towards the direction of autonomous driving but in smaller steps, I think, that then people expected a few years ago. But it comes step by step. And even if you have limited assistance in driving, you have requirements in this functional safety area, even for ACL three.

[18:57] Conor Peick: I tend to think about that in terms of sensors. I mean, that’s what immediately comes to mind of two sensors essentially cross-checking their readings. Is that kind of what you’re talking about?

[19:07] Migo Richter: Yes, well, that’s the redundancy topic. But on top of that, we will see a ton of new sensors. So, sensors monitoring the driver while he’s driving if he pays attention, and if not, warns them. We’ll see lots of lidar and video sensors that create a huge amount of data, which will then result in the necessity for high-speed networks, for example, which make the electrical system more complex. So, this is a kind of a spiral going with all these requirements leading to other requirements, leading to complexity, leading to requirements to reduce or to manage the complexity at the end.

[19:50] Conor Peick: Miguel, you said the magic word there, which is complexity. That seems to be kind of swirling around everything in the automotive industry. So, can you comment on how complexity in the EE world is changing?

[20:02] Migo Richter: Well, for sure it will go up. We’ll see the systems that have a complexity that we didn’t expect to rise that fast. We’ll see levels of complexity we didn’t expect before. And we need tools to handle it. Complexity by itself is not a problem, the challenge is to handle this complexity. And this will really lead to more generative processes to MBSE and MBEE approaches because you can’t continue in some of the very manual processes that we were used to in the last few years. And it will lead, for example, to zonal architectures to break down the complexity into chunks that are easier to manage. But on top of that, of course, you have to manage these zones. You need new architectures and new ECU architectures to manage these individual smaller pieces of complexity. But I think the divide-and-conquer approach that we see in software and everywhere comes into place here as well.

[21:04] Doug Burcicki: Just to touch on that complexity piece, there are many different types of complexity, there’s the physical design, which results in a bill of material. I mean, if you just think of the parts that are coming together to make a vehicle operating and functional, you know, one would argue that the EV architectures are much more simplistic, they’re less complex than an ICE powertrain. And when you look at the pure number of parts, it indeed is. But what becomes complex for these car companies or the OEMs is they’re trying to separate now the software and the hardware development where everything has always been developed, sequentially, in the past together to support one platform implementation. Now, you talk about using pieces of hardware and software across multiple platforms that have very different development life cycles and release timing associated with them. And then you also have hardware that’s in place for years or the lifecycle of that vehicle that you’re going to continuously make software updates and improvements to it. And you have to manage all that together. It has to be traceable, it has to be serviceable, it has to be able to be diagnosed and troubleshot. And that means there’s an extension of that design data, whether it’s hardware or software, all the way into the service lifecycle of the vehicle so that people can maintain and take care of these vehicles on the road.

[22:27] Doug Burcicki: And that whole environment is changing too. Many of these new startups, part of their business model is not to have brick and mortar dealerships because that’s additional cost and that’s significant cost. So, a lot of them are trying to move forward with mobile repair services and capabilities, you know, have vehicles show up at your house or your place of work to take care of whatever issues you’re having if they can’t fix it remotely via software updates or upgrades. And then, some of these companies realize they still need brick and mortar but they don’t want to invest in it, so they enter partnerships with the existing dealership networks, but they have to supply that proprietary data by then to those networks as it’s needed. So, that’s a tremendous degree of complexity there that has nothing to do with the actual design of the vehicle.

[23:17] Doug Burcicki: And then you talk about the physical components that make everything functional. We talk about software, providing features and functions via software. Well, that’s all true and relevant bt you still need mechanical parts; you need switches, you need sensors, you need the motors, you need the actuators, you need the connectors, the terminals, and the wiring that connects it all together. Otherwise, you don’t have power in the ground to complete the circuit. And whatever that device is, is not functional. So, I see a day where you’ll have a base or a standard architecture, if you would, for a respective platform. But just like today, OEMs are always going to want to continue to raise to add new features and functionality to keep pace with the competition or stay ahead of the competition, which means physical components being added at a regular cadence throughout a vehicle lifecycle. And the only way you’re going to be able to do that is to continue to add that wiring physical layer to connect everything and ensure adequate connectivity. They’ll be on top of that standardized platform, vehicle-specific physical layers of connectivity that are added to enable it. And all that physical connectivity needs to be traceable because of ISO-26262 type of requirements that ensure a certain process is followed throughout that lifecycle, it’s documented and it’s verifiable. Again, when we start looking at higher levels of ADAS functionality in the holy grail, trying to achieve the holy grail of full autonomy, there are very few parts of that vehicle that don’t become part of a critical safety system, and thereby, has to be traceable and has to be able to be documented, that requirements were understood, were implemented and were verified as intended. So, complexity is a very broad term. It addresses so many different aspects of the automotive business these days.

[25:16] Migo Richter: And I think this traceability aspect is really a significant topic here because this really leads to some structural changes that are necessary in the development process and in the production process. So, currently, we really see quite a lot of individual silos in our development processes, and then towards the way from the OEM to Tier 1 and into production, where we really use this traceability at several stages if we don’t build a holistic digital twin that will cover this whole development process. And currently, there are really some significant silos in these processes and in the companies and the company structure as well that really make traceability hard. And this is true, for example, for the change management as well. So, if you look at the change level of these cars or of these products during the lifecycle, there are hundreds of changes during their production lifecycle. All this has to be traceable at the end to enable these updates to create some flexibility in there. And to cope with some new legal requirements, for example, for documentation that we need as Doug already mentioned.

[26:29] Conor Peick: Migo, you’re one step ahead of me again, which is great.

[26:32] Migo Richter: Oh, sorry.

[26:34] Conor Peick: No, not at all. It’s perfect because you’re bringing us right into the next idea, which, you know, we’re talking about complexity. And the next thing that comes up, I think, naturally, is how our engineering teams trying to deal with that complexity. And a big thing seems to be collaboration and integration. So, I would love it if you guys could dive in a bit on silos and kind of the challenges those create, and how we can kind of get through that, how can we overcome these traditional silos in vehicle development?

[27:05] Migo Richter: We have the silos in the processes. They are reflected in the tools that the companies are using. They’re reflected in their organizational structure as well. So, it’s really hard to break them. But it’s absolutely necessary to overcome these silos and to create an integrated digital twin across the whole value chain. So, from requirements engineering into the engineering process, into production, into the lifecycle of the product, and even into the recycling phase at the end. So, we really have to create a real holistic digital representation of the product, keep it traceable there, and ensure that we can develop a toolchain that can deliver this. And I think that’s one of the definite strengths of Siemens that we have this huge portfolio with these many tools in there, that we can really cover this. And I think that’s quite unique in the market.

[28:00] Doug Burcicki: Yeah, I think, to Migo’s point, the toolset that enables, or a toolset. It’s not even actually a toolset because there’s no company out there that uses a toolset to do all of this. It’s a patchwork of many different tools with various levels of capability and sophistication. But one thing that’s unique about the Siemens offering – and definitely, very much so around the electrical electronic system space – is the openness and level of integration that we have with all toolsets, whether they are Siemens or not, because we understand that our customers and our customer’s suppliers use various levels or various types of tools, many of which are homegrown tools because they have very unique needs and workflows that they’re trying to address. And over time, they may have found that commercial offering wasn’t to their advantage, so they’ve developed their own. But most of these companies aren’t software companies. So, as we talked about complexity of the designs before, it only makes sense to understand that the sophistication and complexity of the tools need to evolve as well. And so some of these companies are having a hard time maintaining what we would refer to as a modern toolset that enables the level of functionality that they need.

[29:22] Doug Burcicki: And we’ve actually seen quite a few of these companies that have developed and maintained their own tools over the last 20-25 years start to move away from that, because it is a huge resource drain on them. Big teams of engineers keeping these tools up and running and doesn’t contribute to their core business model. There is a shift in that space, I would say. And what’s really interesting is it goes hand-in-hand with the shift in the supply base. I used the word “sequential” before. There used to be a very clear hierarchy of an OEM, a Tier 1, Tier 2, Tier 3 within the supply base, and it moved up word. The threes fed the twos, the twos fed the ones, and the ones fed the OEMs. Well, nowadays, I refer to it as a supply ecosystem because, number one, you have companies that were not part of the supply base 10 years ago are very predominant in and now. Some of these companies came in from consumer electronics, some of them came in from industrial applications. So, if you think about it, it makes sense. Most OEMs didn’t really care much about magnetic motors a few years ago. Well, now they all do. And there are four of them on most vehicles. And the traditional suppliers didn’t supply that capability.

[30:35] Doug Burcicki: So you see companies like [30:37 inaudible] in the space, and they were never part of that conversation in the past. And then you look at the software companies, and then you look at some of the handset or the mobile phone companies, I mean, many of them have attempted or are in the process of developing their own vehicles or their first vehicles. But then you also have OEMs that have entirely different business models, and thus levels of vertical integration. You can go on one extreme. You look at a Tesla where they develop a majority of their own software. And they’ve defined and specked out their own chips that are specific to only their vehicles. And they’re one of the only companies in the world right now that’s not suffering from a chip shortage because there’s no competition for those chips, they’re the only ones buying them. Whereas every other OEM is fighting for what few chips are available on the market. So, now, because of that level of vertical integration, they’ve removed things like supply chain risk from their equation to a certain extent. So, you’re seeing other inherent benefits besides technical to some of these different approaches.

[31:42] Doug Burcicki: But then you can go to the other end of the spectrum, where you see a company like Fisker, who’s done a fantastic job designing a vehicle, they have a badge to put on that vehicle. But they’re essentially outsourcing 90% of the value stream to companies like Magna and Foxconn to develop that vehicle, to develop the software stack that’s going to operate that vehicle, and to ensure that there’s a quality product produced at the end of the day. They’re not doing any of that in house. So, there’s a tremendous wide array of business models out there. And that’s part of what’s driving this supply ecosystem and the roles of suppliers are changing. And you know, in that case, you have what’s referred to as Tier 0.5, they’re essentially an OEM but they’re not an OEM, but they’re doing most of what a traditional OEM would have done. So, you can’t do all of that without having a pretty healthy, continuous data flow, a master set of data that’s being utilized by all the parties that are involved in order to make sure that there is the traceability of that design integrity but also to adhere to all of those ever-growing list of release events that are taking place and need to be done in an orchestrated effort in order for to bring that vehicle to market on time.

[33:05] Migo Richter: And I think this reference to software companies is really important. So, in my last life, I’ve been working for software companies developing huge software solutions. And in the software development world, we’ve been using things like continuous integration and controlled agile processes with scrum and testing teams that are completely integrated into the development process for 30 years now. And I think these companies can really learn or adopt lots of these technologies that have been proven in the software industry and apply it to the EE systems development now.

[33:42] Conor Peick: I think that also comes to the idea of this accelerated sort of development cycle within the automotive industry. And it seems particularly with EVs right now, where companies are really trying to get their electric vehicle out to market within the next couple of years. Because if they don’t, then they’re going to be way behind the competition. In fact, you could argue they’re already behind the competition. So, with things accelerating, that’s also going to change the development process and the needs of these engineering teams as well. So, that probably is going to drive a need for integration. And, Doug, you talked about continuous data flow, digital thread, and all those things.

[34:19] Doug Burcicki: Yeah, I mean, speed to market is probably one of the most valuable aspects to all these companies right now. The startups – to lump them into one category if I would – in certain ways, they have it a little easier because they’re starting from a clean sheet of paper. They don’t have platform complexity. They don’t have an existing infrastructure that’s heavily invested in the ice powertrains and methodologies. They’re dealing with a much lower level of complexity, to say the least, from a vehicle development, manufacturing, and delivery perspective. But at the same time, the speed is of the essence because a lot of them are securing funding every step of the way, as they go through new milestones, they secure more funding. If they miss milestones, then they cease to exist. So, it’s a fine line that they’re walking. The OEMs have a much different challenge. They’re trying to bring to market EVs that are attractive, meet their historical quality, performance levels, maintain their space in the industry that they’ve carved out over the last 100 years or more in some cases. But we got to be pragmatic too. EVs are growing exponentially, almost, but they’re still 5% of the global revenue or global sales of car.

[35:46] Doug Burcicki: So, for a legacy OEM that produces between five to 10 million vehicles a year globally, how much do you invest in that small of a piece of the pie? You have to balance that. Because the investment in an EV, whether you’re building 100 or 100,000, is basically the same. So, they’re trying to balance that that business model trade-off that I spoke about early on, like the same way that companies were 100 years ago. So, that’s their big challenge. And that’s why when they do make the decision to go to market with an EV, they want to do it as fast as they can so they can realize revenue return on that investment. They can’t afford to wait 5-10 years, like, essentially, Tesla was in existence and producing vehicles for 10 years before they became profitable. You could argue that it would have been even longer if they weren’t selling cafe requirements to the legacy OEMs along the way. So, there’s a lot of different moving parts there. The speed at the end of the day is always of the essence. But no company wants to trade quality and performance in lieu of speed. So, yeah, that is a holy grail for these companies right now. And that’s one thing, competition does that. The new entrants have brought in a different type of competition. We’ve all seen companies that five years ago were kind of downplaying the EV trend or fad, could have been referred to. Now, quickly trying to change their entire portfolios and committing to ice-free fleets within the next decade if not sooner. And that’s just an absolutely massive transformation of their corporate infrastructure as well as the organizations that are delivering those vehicles.

[37:31] Conor Peick: And Migo, I think this does play into what you mentioned with the sort of agile development practices. It seems like that could become a good strategy for these companies as they’re trying to meet these accelerated timelines.

[37:43] Migo Richter: Yeah. Definitely, it will. And as Doug said, there will be quite different challenges for the legacy OEMs versus the new entrants. And for the legacy, it will be harder to move into this kind of agile process due to their existing organizational structures and their experience. But on the other side, I think some of the new entrants already learned that it’s really hard to produce cars in larger scale. So, it’s always quite quick to get the first prototype running in on the streets and for the shows. But it’s a different story to produce several million of these cars. And that’s probably one of the aspects where the legacy OEMs can play their experience and scale the production faster than the other ones, probably. So, I think it’s different challenges for both sides. But at the end, it’s quite a lot of challenges for both, and they will have to find solutions for that.

[38:37] Conor Peick: Yes. It’s going to be, I think, a very interesting race, I suppose. I think it’s just about time for us to sum up. So, to leave off, I’d like to ask each of you if there’s maybe one thought that you’d like to leave the listeners with coming out of this podcast?

[38:55] Doug Burcicki: Well, at the end of the day, I think the consumer is the winner in all this because there are so many differences in how the automotive business is conducting itself compared to just 10 years ago. It’s hard to list them all here. But 10 years ago, if you would have asked the average consumer to plunk down a few $1,000 in the car that they might have in two years, there’s no way they would have done that. Now, Ford, with their new Lightning pickup truck, actually shut off orders. They won’t take any more pre-orders for a vehicle that they’re not going to start producing for another six to eight months. I mean, it’s incredible how different the business models are and the consumer behavior behind these vehicles that are coming to market. There’s true excitement. People are passionate about these new vehicles, which clearly goes back to the point I made before. They’re designed for the consumer. They’re not just an EV that’s on a platform that the OEM had available that they could pack a battery pack module onto and still put the seats in the cab on it. It’s a bespoke design for that intended purpose. And these vehicles have personality, they’re fit for purpose, and the consumers are excited about them. And that’s whether you’re driving a hypercar, like some of these companies are producing and they may only make 100 of them in a year, or you’re looking for a state-of-the-art pickup truck to go to the job site every day and do what you’ve done for years just to a different degree of quality and style in many cases. And what also amazes me is the amount of features and functionality that is available in what we would refer to as a basic vehicle these days. The stuff that has become standard is absolutely incredible. Even though they’re not state-of-the-art systems, you can, pretty much, from a mid level trim on up have a level two ADAS System in your vehicle that assist you with lane center keeping, and lane departure warning, and maybe even parked the vehicle for you as well in a parallel parking situation. So, it’s very impressive what’s happened in a very short amount of time. And at the end of the day, the consumers are the winners in all this. Competition always results in the marketplace winning.

[41:18] Conor Peick: I really couldn’t agree more. I think cars are just about as good if not better than they’ve ever been, whether all-electric or the current stuff you can get, and even ice vehicles. It’s pretty impressive. So, Migo, if you could sum up everything into one thought? That’s the challenge.

[41:36] Migo Richter: Yeah, I would really say that it’s really exciting times. And I spent so many years in this industry. And currently, we really see one of the largest disruptions in decades probably. I think it’s a great opportunity as well to be part of this change and of this industry and see what will happen there, and actively influence what is happening there. And I’m really curious to see, maybe in five years again or so, and especially with my own kids, how this will develop. And I think we’ll see a quite different automotive industry. But as Doug says, it’s really cool new products coming up, new functionalities that we wouldn’t have expected a few years ago. So, yeah, that will be fun, I guess.

[42:23] Conor Peick: Absolutely. All right. Well, Dou, Migo, thank you guys so much for joining me today. We’ve had a really good conversation here. So, yeah, I’d just like to thank you for your time and all your vast knowledge as well. We really appreciate it.

[42:37] Doug Burcicki: Thank you. Always a pleasure.

[42:38] Migo Richter: Thank you, Conor.